-

USD/CHF moves sideways as markets adopt a cautious stance.

-

Investors focus on Fed Chair Powell’s involvement in a panel discussion, seeking fresh cues.

-

US Dollar experiences lukewarm response despite hawkish remarks from Fed officials.

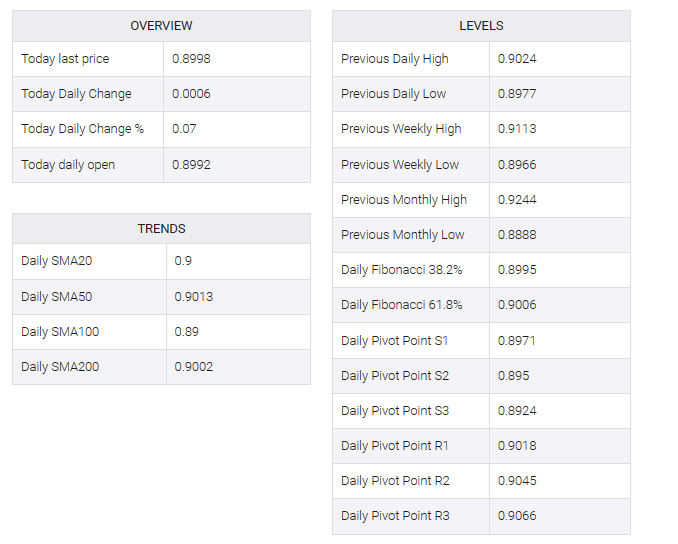

USD/CHF recovers recent losses, hovering near the 0.9000 psychological level during the European session on Thursday. The USD/CHF pair moves sideways as the market shifts confidence due to US Federal Reserve (Fed) officials’ showing resistance against lowering interest rates.

During the US central bank’s statistics conference on Wednesday, Fed Chair Jerome Powell decided not to provide comments on monetary policy. Investors’ attention now turns to Powell’s participation in a panel discussion later today, where he is expected to share insights and perspectives on “financial challenges in a global economy.”

As the US Dollar Index (DXY) settles near 105.50, US Treasury yields take their toll. The 10-year US bond yield was around 4.49% on Thursday. Moreover, Fed officials have expressed their reluctance to entertain the idea of cutting interest rates. However, despite this position, the greenback faces challenges in the market.

Fed Governor Michelle Bowman has suggested that the central bank is considering future hikes in short-term interest rates by introducing an element of uncertainty. Conversely, Minnesota Fed President Neal Kashkari is skeptical that the central bank has raised rates enough. He cites the resilience of the economy as an important factor in shaping his approach to monetary policy.

Switzerland’s seasonally adjusted Unemployment Rate (MoM) remained steady at 2.1% in October, according to data released by the State Secretariat for Economic Affairs (SECO). Additionally, the contained conflict between Israel and Hamas has improved market sentiment, potentially impacting the safe-haven status of the Swiss Franc (CHF).