-

USD/CHF oscillates in a trading band around 0.8520 on Friday.

-

The upbeat US inflation and labor market data could challenge an expected March rate cut by the Federal Reserve (Fed).

-

The escalating tension in the Middle East might benefit the safe haven currency like the Swiss Franc (CHF).

-

The December US Producer Price Index (PPI) will be the highlight on Friday.

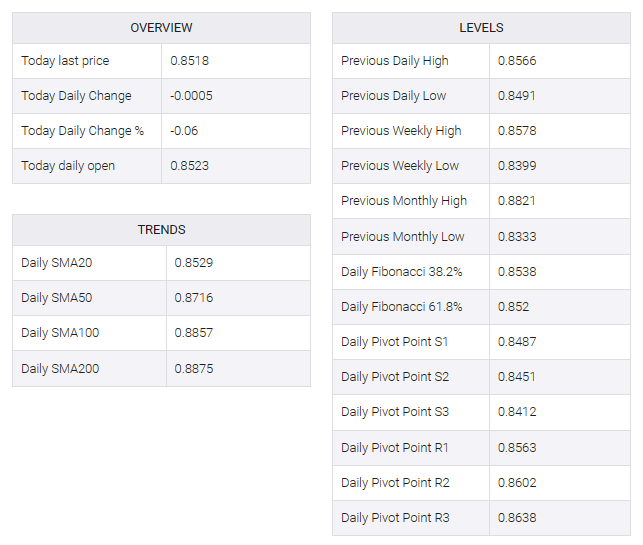

The USD/CHF pair remains confined within a multi-week trading range of 0.8400-0.8575 during the early European trading hours on Friday. The firmer US Dollar (USD) following the upbeat US inflation data might lend some support to the pair. However, the upside of USD/CHF might be limited due to the escalating tension in the Middle East. At press time, the pair is trading at 0.8520, losing 0.02% on the day.

US inflation rose in December. The US headline Consumer Price Index (CPI), according to the Bureau of Labor Statistics, rose at an annualized pace of 3.4% in December from 3.1% the previous month, beating expectations of 3.2%. On a monthly basis, the CPI number increased 0.1% to 0.3% in November. That being said, upbeat US inflation and labor market data could lead to the March rate cut expected by the Federal Reserve (Fed).

On the other hand, rising tensions in the Middle East could lift safe haven flows like the Swiss Franc (CHF). On Thursday, US and UK forces struck several Houthi targets in Houthi-controlled areas of Yemen. US President Joe Biden said, “This attack was carried out in direct response to Houthi attacks against international maritime vessels in the Red Sea.”

Earlier this week, the Swiss Consumer Price Index (CPI) for December came in better than expected, rising to 1.7% YoY from the previous reading of 1.4%. Real retail sales rose 0.7% in November vs. -0.3% previously, beating estimates.

Moving on, the December US Producer Price Index (PPI) is due later on Friday, which is forecast to rise 0.1% MoM and 1.3% YoY. Traders will take further cues from this data and find trading opportunities around the USD/CHF pair.