-

USD/CHF takes offers to renew intraday high even as risk-aversion prevails.

-

US Dollar struggles to track upbeat yields amid strong China data, softer statistics at home.

-

Downbeat Swiss GDP, hawkish Fed bets favored buyers the previous day.

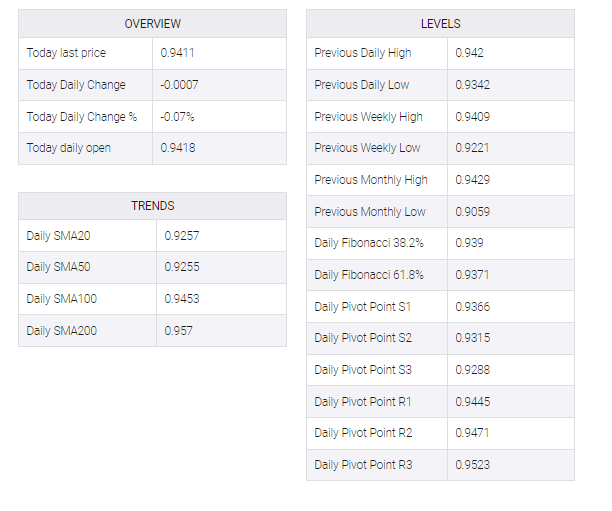

USD/CHF renewed its intraday lows around 0.9410 as bulls took a breather after a strong February performance early on Wednesday. In doing so, the Swiss currency pair failed to justify the market’s mildly offbeat tone amid fears of higher rates and inflation. The reason may be linked to China as the world’s largest industrial player’s latest activity data came in impressive in February.

That said, China’s Caixin manufacturing PMI tracks official activity data per NBS manufacturing and non-manufacturing PMIs to mark a strong economic rebound in February. Despite this, China’s Finance Minister Liu He said after the release of the data that the foundations of China’s economic recovery were not yet stable.

It should be noted that the month-to-date consolidation and recently soft US data also seem to favor the USD/CHF bear. On Tuesday, the US Conference Board’s (CB) consumer confidence fell for the second month in a row to 102.9 vs. 106.0 previously (revised) while the US housing price index fell 0.1% in December vs. -0.6% market forecast and -0.1% previously. Along the same lines, the S&P/Case-Shiller home price index rose 4.6% YoY in the month, compared to market expectations of 6.1% and previous readings of 6.8%. Furthermore, the Chicago PMI for February eased to 43.6 from the previous reading of 44.3 and the market consensus of 45.0 while the Richmond Fed manufacturing index for the month was below 11.0 previously and -5.0 -16 expected.

Nevertheless, market fears of higher inflation and interest rates keep USD/CHF buyers optimistic. Portraying sentiment, S&P 500 futures tracked modest losses on Wall Street near 3,960. Further, the US 10-year Treasury bond yield rose two basis points (bps) to 3.93% while the two-year counterpart rose four bps to 4.84% by press time. With that, both key bond coupons advanced to three-month highs marked in February after printing their biggest monthly gains since September 2022.

Apart from the risk-off mood, downbeat data at home could keep USD/CHF buyers optimistic. Swiss gross domestic product (GDP) reached 0% in the fourth quarter (Q4) of 2022 versus growth of 0.3% and 0.2% in the third quarter.

Going forward, Swiss real retail sales for January may lead the immediate USD/CHF ahead of US activity data for the month. However, next week’s monthly jobs report, Federal Reserve (Fed) Chairman Jerome Powell’s testimony and the Federal Open Market Committee’s (FOMC) monetary policy meeting will be the main focus for clear guidance.

Technical analysis

USD/CHF pullback remains elusive unless the quote drops back below the 100-day Exponential Moving Average (EMA) level surrounding 0.9385.