- USD/CHF trades with a negative bias for the second straight day amid a softer USD.

- The Fed rate-cut uncertainty might hold back traders from placing directional bets.

- A positive risk tone could undermine the CHF and limit losses ahead of the US CPI.

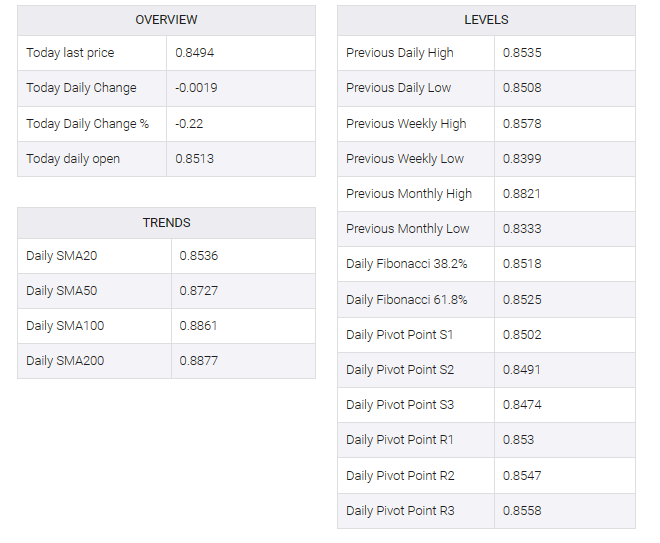

The USD/CHF pair turned lower for a second day on Thursday and slipped below the 0.8500 psychological mark during the Asian session. Spot prices, however, remained confined to a familiar trading band held for the past two weeks or more as traders keenly await the release of the latest US consumer inflation figures before placing new directional bets.

Moving to US key data risks, the US dollar (USD) remains depressed at a one-week-old range amid uncertainty over the Federal Reserve’s (Fed) rate-cut path and is exerting some pressure on the USD/CHF pair. . That said, incoming US macro data underscored the fundamental resilience of the American economy. That, along with mixed signals from several Fed officials, has led investors to scale back expectations for more aggressive policy easing in 2024.

Indeed, New York Fed President John Williams said on Wednesday that the US central bank is in a ‘good place’ and has time to think about what’s next for rates, although eventually policy should be brought back to a more neutral level. In contrast, Atlanta Fed President Raphael Bostic noted earlier this week that the central bank still needs to bide its time for tighter policy to work to lower inflation, which has fallen more than expected and seen two 25 bps cuts by the end of the year.

Nevertheless, reduced odds for an imminent Fed rate cut in March allowed the benchmark 10-year US government bond yield to remain above the 4.0% threshold and supported the potential for some USD deep-buying to emerge. Apart from this, a general positive tone around equity markets is likely to weaken the safe-haven Swiss Franc (CHF) and help limit deeper losses for the USD/CHF pair, warranting caution for aggressive bearish traders.

Investors may also prefer to wait for the release of the latest US consumer inflation figures, later during the first North American session, which will influence the Fed’s future rate decisions. This, in turn, will play a key role in driving USD demand and determining the next step in a directional move for the USD/CHF pair.