-

USD/CHF comes under heavy selling pressure on Thursday and snaps a two-day winning streak.

-

The positive news surrounding the Credit Suisse saga boosts the CHF and drags the pair lower.

-

A softer USD also contributes to the slide, though hawkish Fed expectations could limit losses.

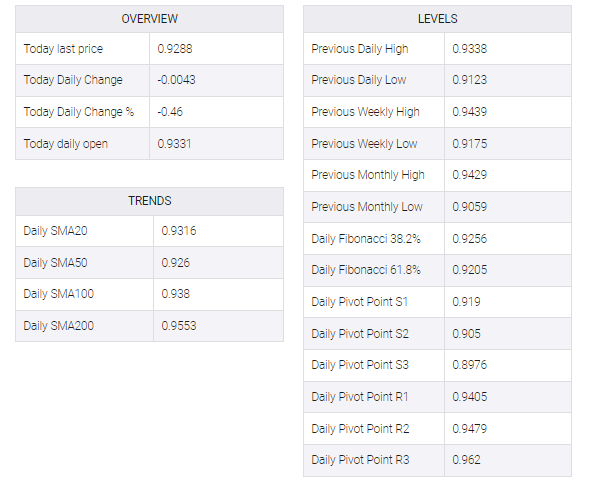

The USD/CHF pair attracted some sellers near the 0.9340 area on Thursday and eroded a portion of the previous day’s huge rally of 220 pips – the biggest one-day gain since 2015. The pair continued to decline through the early European session and slide back below the 0.9300 mark, a fresh daily low hit in the past hour.

The Swiss Franc (CHF) strengthened in response to a positive development around Swiss lender Credit Suisse and appeared to be the main factor dragging the USD/CHF pair lower. Indeed, the troubled Swiss bank has announced that it will exercise an option to borrow up to $54 billion from the Swiss National Bank (SNB) to boost liquidity. Adding to this, the chairman of the Saudi National Bank, Ammar Al Khudairi, has reportedly said that the panic surrounding Credit Suisse is unwarranted and that regulators are ready to plug the holes.

Saudi National Bank – the largest shareholder of Credit Suisse Group AG – on Wednesday rejected another call for additional liquidity and helped ease fears of a full-blown global banking crisis. This, in turn, eroded the US dollar’s status as the global reserve currency and put additional downward pressure on the USD/CHF pair. That said, the Federal Reserve reviving bets for a rate hike of at least 25 bps at its upcoming meeting on March 21-22 could limit any deeper losses for the greenback and provide some support to the major.

Nevertheless, spot prices, for now, seem to have snapped a two-day winning streak as traders now look to US macro data for fresh stimulus. Thursday’s US economic docket released general weekly initial jobless claims, the Philly Fed manufacturing index, building permits and housing starts. This, along with European Central Bank-inspired volatility – could affect the buck and the USD/CHF pair.