-

USD/CHF bounces off five-week low to print the first daily gain in five.

-

US Dollar traces corrective bounce off yields to pare recent losses.

-

Interest rate futures raise doubts on further USD/CHF advances unless US inflation markets notable jump.

USD/CHF seesaws around intraday high during the first positive day in five heading into Tuesday’s European session.

In doing so, the Swiss Franc (CHF) pair traces the US Dollar’s latest corrective bounce amid a recovery in the US Treasury bond yields ahead of the Consumer Price Index (CPI) data. It should be noted, however, that the recently downbeat market concerns surrounding the Federal Reserve (Fed) seem to test the buyers ahead of the key US data.

That said, the US 10-year Treasury bond printed a mild gain of around 3.58% after bouncing off a monthly bottom of 3.418%, while the two-year counterpart rebounded from the lowest level since September 2022 to print a mild gain of around 4.19% by press time. It should be noted that the US two-year Treasury bond yield fell the most since 1987 the previous day.

A major slump in the US Treasury bond yields could be linked to the fears emanated from the Silicon Valley Bank (SVB) and the Signature Bank fallouts, despite the US authorities’ defense.

While talking about the Fed bets, CME said, “Traders see 33% chance Fed holds rates this month, market pricing shows rate cuts expected as early as June.” On the same line Reuters mentioned that the US Fed Fund Futures have priced in a 69% chance of a 25-bps hike at next week’s Fed policy meeting, with a more than 30% probability of a pause,” said Reuters. The news also added that the market last week was poised for a 50-bps increase prior to the SVB collapse.

Amid these plays, Wall Street closed mixed and so do stocks in the Asia-Pacific region while S&P 500 Futures snap a three-day downtrend by bouncing off the lowest levels since early January.

Looking ahead, the US CPI will be more important for the USD/CHF pair traders as the Fed bets have already reversed. As per the market forecasts, the headline US CPI is likely to ease to 6.0% YoY versus 6.4% prior while CPI ex Food & Energy may slide to 5.5% YoY from 5.6% prior.

Also read: US Inflation Preview: Five scenarios for trading the Core CPI whipsaw within the SVB storm

Technical analysis

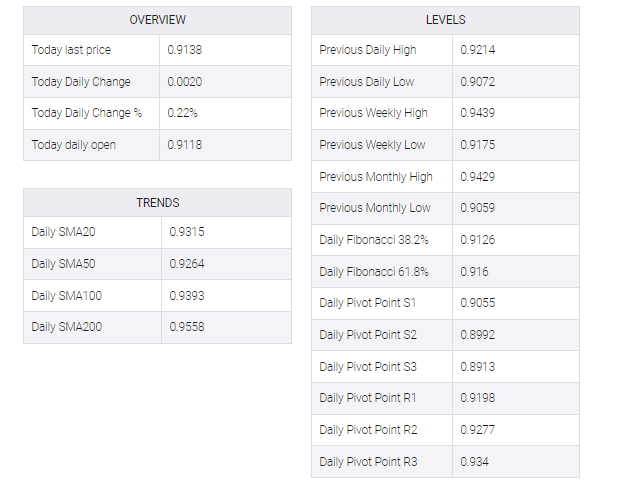

A clear downside break of the five-week-old ascending support line, now resistance around 0.9335, keeps USD/CHF bears hopeful of testing the previous monthly low of 0.9060.