-

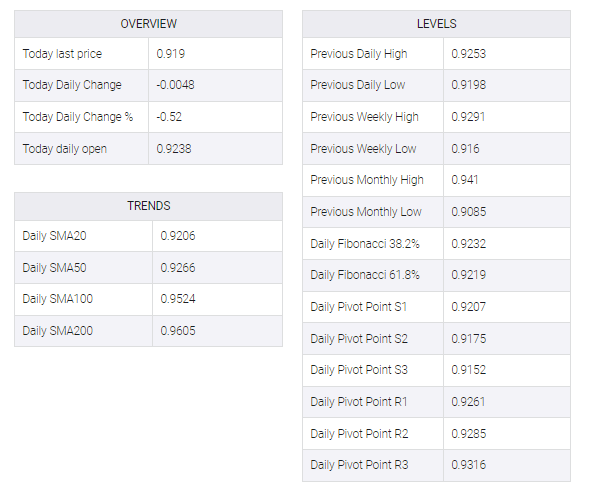

USD/CHF has shifted its auction below 0.9200 despite the cheerful market mood.

-

The market sentiment could get dismal if the US inflation figure shows a U-turn after declining for three months.

-

A rise in the Swiss CPI strengthened the Swiss National Bank’s case for further interest rate hikes.

The USD/CHF pair has shifted its business below the round-level resistance of 0.9200 in the early Asian session. The Swiss Franc asset is expected to deliver more losses as investors have ignored the consequences associated with the United States inflation, in case it delivers a surprise upside. The risk appetite of the market participants has improved dramatically and has provided support to the risk-sensitive assets.

S&P500 futures are looking to extend their upside as investors have also ignored the geopolitical fears linked to the airborne threats to the United States. The US Dollar Index (DXY) is struggling to reclaim the critical resistance of 103.00 amid the risk-on mood. Meanwhile, a recovery in the demand for US government bonds has dragged the 10-year US Treasury yields to near 3.70%.

Investors are looking casual ahead of the US inflation release, however, market sentiment could turn sour if the inflation picture shows a U-turn after falling significantly over the past three months.

Analysts at TD Securities forecast a solid 0.4% MoM gain in the core CPI series. In terms of headlines, we expect CPI inflation to register its strongest MoM gain since October, posting a robust 0.4% increase. Our MoM estimates indicate that inflation may lose momentum again on a YoY basis in January as we look for headline inflation to ease to 6.2% (after 6.5% YoY in December) and core series to ease to 5.5% YoY. (after 5.7% in January).”

On the Swiss Franc front, an increase in the Consumer Price Index (CPI) has bolstered the case of more interest rate hikes by the Swiss National Bank (SNB) ahead. On Monday, the Swiss Federal Statistical Office reported a rise in the monthly CPI figure by 0.6% vs. the consensus of 0.4%. And, the annual inflation rate rose to 3.3% from the estimates of 2.9% and the former release of 2.8%.

SNB Chairman Thomas J. Jordan has already cleared that the inflationary pressures are beyond the control of the central bank. Therefore, the case calls for more interest rate hikes by the SNB ahead.