-

USD/CHF faces barriers despite improved Greenback.

-

SNB might have intervened in the foreign exchange market to support the Swiss Franc.

-

The risk-off mood turned the investors toward the US Dollar.

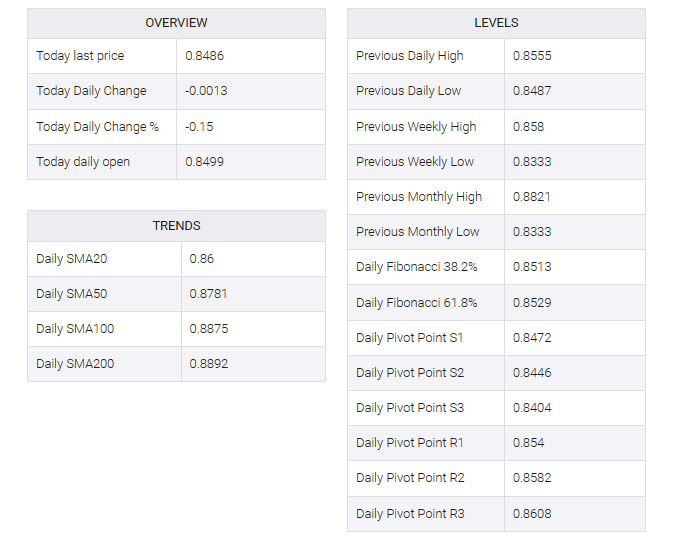

USD/CHF extended its losses for a second straight session on Thursday, trading lower around 0.8480 during Asian trading hours. The USD/CHF pair feels bearish pressure despite a stronger US Dollar (USD), which can be attributed to foreign exchange market intervention from the Swiss National Bank (SNB).

Additionally, the SVME Manufacturing Purchasing Managers Index (PMI) for December was released on Wednesday, with an improvement to 43 from 42.1 previously. Buyers of the Swiss Franc (CHF) may be influenced by improved business conditions in the manufacturing sector.

On the other hand, expectations of slower global growth towards the end of 2024 have created a risk-off market sentiment, forcing investors to take refuge in the US dollar (USD). Additionally, improving US bond yields bolstered the greenback’s strength. The U.S. dollar index (DXY) edged closer to 102.40 after recent gains, with 2-year and 10-year yields on U.S. Treasury bonds at 4.33% and 3.93%, respectively, higher by press time.

The USD’s positive momentum appears to have been bolstered by Wednesday’s favorable ISM Manufacturing PMI report, which revealed an increase to 47.4 from the previous 46.7 in December, beating the market consensus of 47.1. However, there is an opposite trend as JOLTS job openings fell to 8.79M, below the 8.85M number expected for November.

Looking ahead, the market focus will be on Thursday’s labor market data releases, including ADP Employment Change and Initial Jobless Claims, providing further insights into the economic scenario.