-

USD/JPY attracted some deep-buy on Thursday and turned positive for the third day in a row.

-

Fed-BoJ policy divergence weighs on the JPY and lends support to the pair.

-

Sliding US bond yields put USD bulls on the defensive and could cap any further gains.

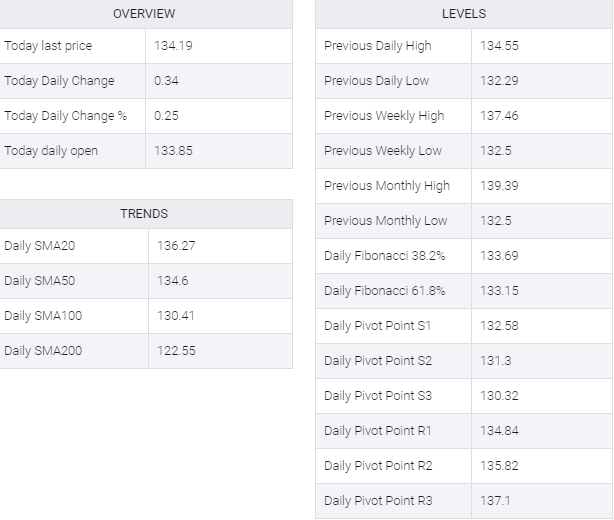

The USD/JPY pair reverses an intraday dip to the 133.40 area and turns positive for the third straight day on Thursday. Spot prices climb back above the 134.00 mark during the early European session, with bulls now eyeing a move towards the weekly high touched the previous day.

A major deviation in the monetary policy stance taken by the Federal Reserve and the Bank of Japan continues to weigh on the Japanese yen, which in turn, acts as a tailwind for the USD/JPY pair. It’s worth noting that several Fed officials hinted this week that more interest rate hikes are on the way in the near term. In contrast, the BoJ has repeatedly called for sticking to its ultra-easy policy settings and pledge to keep 10-year Japanese government bond yields close to 0%.

The USD/JPY pair’s upside, however, appears to be limited amid ongoing declines in US Treasury bond yields, putting US dollar bulls on the defensive. Beyond that, the cautious mood around equity markets could lend some support to the safe-haven JPY and contribute to capping any meaningful upside for the USD/JPY pair, at least for the time being. This makes it wiser to wait for a strong follow-through buy before positioning for a more complimentary move.

Thursday’s key focus would remain on the Bank of England monetary policy decision, which could infuse some volatility in the markets and provide some impetus to the USD/JPY pair. Traders will further take cues from the release of the usual Weekly Initial Jobless Claims data from the US, due later during the early North American session. This, along with the US bond yields and Fedspeak, might influence the USD price dynamics and allow traders to grab short-term opportunities.