-

USD/JPY receives upward support on hawkish remarks by the Fed Powell.

-

Japanese authorities may intervene in the FX market to provide support for the JPY.

-

BoJ Governor Ueda mentioned that the central bank will approach the exit from ultra-loose monetary policy.

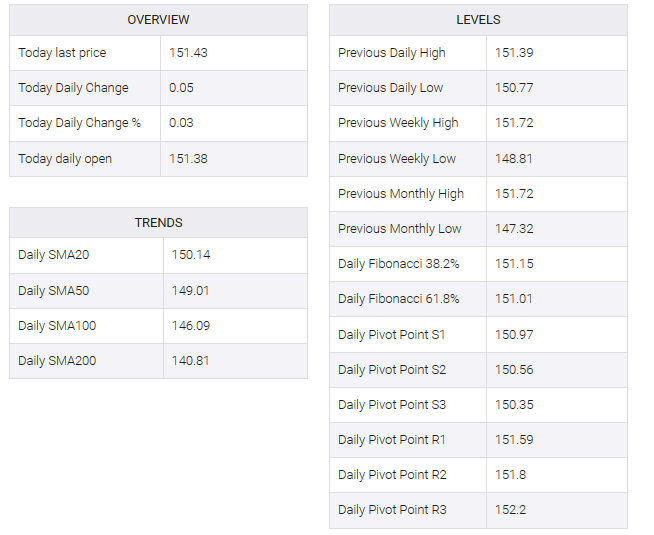

USD/JPY continued its winning streak for the fifth day in a row, trading near 151.40 in the early European session on Friday. Federal Reserve (Fed) Chair Jerome Powell’s unexpected hawkish comments had a significant impact, raising US Treasury yields and strengthening the US Dollar (USD) against the Japanese Yen (JPY). However, Japanese authorities may consider intervening to stem the USD/JPY pair’s advance in response to these developments.

Fed Chair Powell’s statement at an International Monetary Fund (IMF) event on Thursday, expressed concern that current policies may not be enough to control inflation. The sentiment lifted the US dollar index (DXY), which hovered around 106.00, with the 10-year US bond yield at 4.62% at press time.

Despite aggressive tightening policies by major central banks, the Bank of Japan (BoJ) has maintained its dovish stance. BoJ Governor Kazuo Ueda said Thursday that the central bank will cautiously exit ultra-loose monetary policy to prevent significant volatility in bond markets.

However, the Japanese yen continues to face pressure as low wage growth could delay plans to exit the ultra-loose policy stance. Modest wage growth is seen as an important factor for the Japanese central bank to consider exiting a prolonged easy monetary policy.

Market participants keep a close eye on the Fed’s Logan speech and the preliminary Michigan Consumer Sentiment Index for November, as traders seek cues to identify trading opportunities within the USD/JPY pair.