-

USD/JPY sees late rally, jumps to 142.60.

-

The US Dollar is paring back the day’s losses as the Yen declines.

-

US inflation continues to erode faster than expected.

USD/JPY surged to new highs on Friday as the US dollar (USD) tries to recoup some of the day’s losses and the broader Japanese yen (USD) weakens as markets prepare to finally wrap up the trading day ahead of the holiday break and the end of 2023. Full trading week.

The yen saw an initial bump on Friday after Japan’s National Consumer Price Index (CPI) inflation, including core Japan CPI (headline CPI less fresh food prices) printed roughly 2.5% against market forecasts for November to a previous print of 2.9%.

Japanese inflation continues to edge back toward the Bank of Japan’s (BoJ) 2% target, but the BoJ continues to dampen market hopes for a hawkish pivot from Japan’s central bank. The BoJ remains unconvinced that Japanese inflation will remain above 2%, and the BoJ remains firmly entrenched in hyper-easy monetary policy with negative interest rates.

The BoJ currently expects inflation to fall below the 2% annual rate sometime in 2025.

The US dollar fell once more on Friday after the US Personal Consumption Expenditures (PCE) price index fell faster than expected, seeing a resurgence of rate cut expectations from the market. The greenback is now giving back the day’s losses going into the back half of the week’s final trading session.

The core US PCE price index for the year to November softened to 3.2%, below market forecasts of 3.3% and easing from a previous print of 3.4% (revised from 3.5%).

Also Read: US PCE inflation softens to 2.6% from a year ago vs. 2.8% expected

Rising US inflation weighed on the US dollar this week, sparking a resurgence in investor expectations of an increased pace of rate cuts in 2024. Interest rate expectations show a median forecast of a rate cut of 75 basis points by the end of 2024, but markets are currently pricing in a 160 basis point bet on rising rates, with some particularly overzealous market participants betting on a rate cut as soon as next March.

USD/JPY Technical Outlook

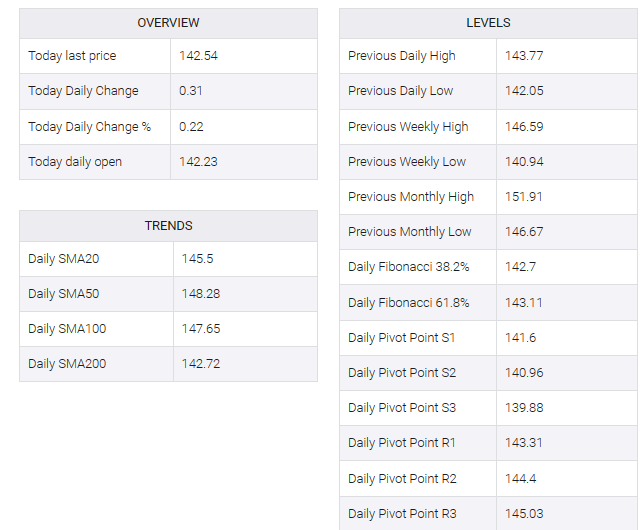

The USD/JPY set a new high for Friday at 142.66, stopping just short of the 50-hour Simple Moving Average (SMA) as the pair gets hung up on near-term resistance levels.

Despite USD/JPY’s Friday rebound, the pair remains firmly bearish, with an unavoidable lower-highs pattern baked into the charts.

The pair remains constrained at the 200-day SMA rising into the 143.00 handle, and the USD/JPY is down over six percent from November’s peak bids near 151.90.