-

USD/JPY remains confined in a narrow range through the Asian session on Friday.

-

Traders opt to wait on the sidelines ahead of the crucial US monthly jobs report.

-

The divergent Fed-BoJ policy outlook continues to act as a tailwind for the major.

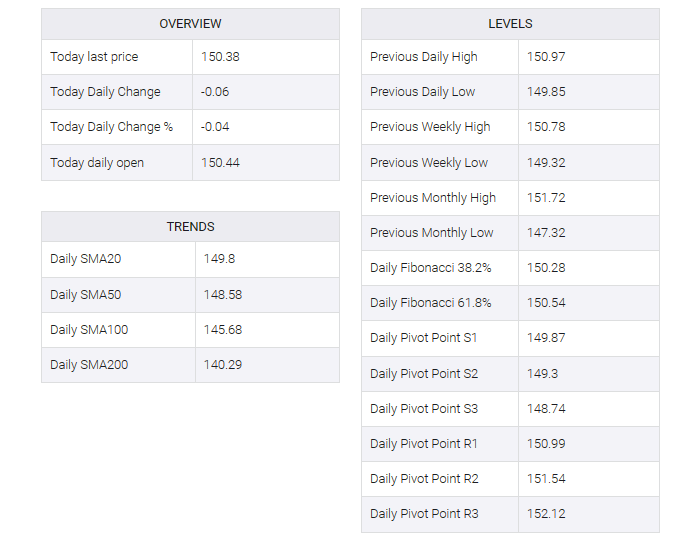

The USD/JPY pair struggled to make a modest overnight bounce from the 149.85-149.80 region and oscillated in a narrow trading band during the Asian session on Friday. Spot prices currently trade below the mid-150.00s, almost unchanged for the day, as traders appear reluctant to place aggressive bets amid uncertainty over the Federal Reserve’s (Fed) rate-hike path.

The US central bank decided to leave overnight interest rates unchanged for the second time in a row, although it acknowledged the need for another rate hike on the back of the unexpected resilience of the US economy. However, Fed Chair Jerome Powell noted in a post-meeting news conference that monetary conditions may already be tight enough to contain inflation. This, in turn, fueled speculation that the Fed has hiked rates and may begin cutting rates by June next year. The outlook, meanwhile, led to a recent sharp pullback in US Treasury bond yields, putting US dollar (USD) bulls on the defensive and acting as a headwind for the USD/JPY pair.

In addition, the Japanese government’s coercion to counter a sustained devaluation of the domestic currency further contributed to spot price capping. Furthermore, market participants chose to stay on the sidelines and await the release of the closely watched US monthly employment data, or NFP report, later in the first North American session. USD/JPY’s downside, however, appears to be limited given a dovish stance adopted by the Bank of Japan (BoJ). Indeed, the BoJ has pledged to support the domestic economy and continue its highly accommodative policy until the 2% price target is achieved sustainably.

Moreover, the BoJ’s minor change to its yield curve control (YCC) policy pointed to a slow move towards exiting the decade-long accommodative regime. This, along with the prevalent risk-on mood, could undermine the safe-haven Japanese Yen (JPY) and lend support to the USD/JPY pair. Nevertheless, spot prices still seem poised to register modest weekly gains and the aforementioned fundamental backdrop warrants some caution for aggressive bearish traders. Hence, it will be prudent to wait for strong follow-through selling before confirming that the pair has formed a near-term top around the 151.70 region, or the highest level since October 2022 touched on Tuesday.