-

USD/JPY experiences a 0.52% decline in the North American session.

-

A lower-than-expected ISM manufacturing reading for November weighed on the US Dollar.

-

Fed Chair Jerome Powell acknowledges some easing in inflation but emphasizes that core inflation remains high and monetary policy decisions will be data dependent.

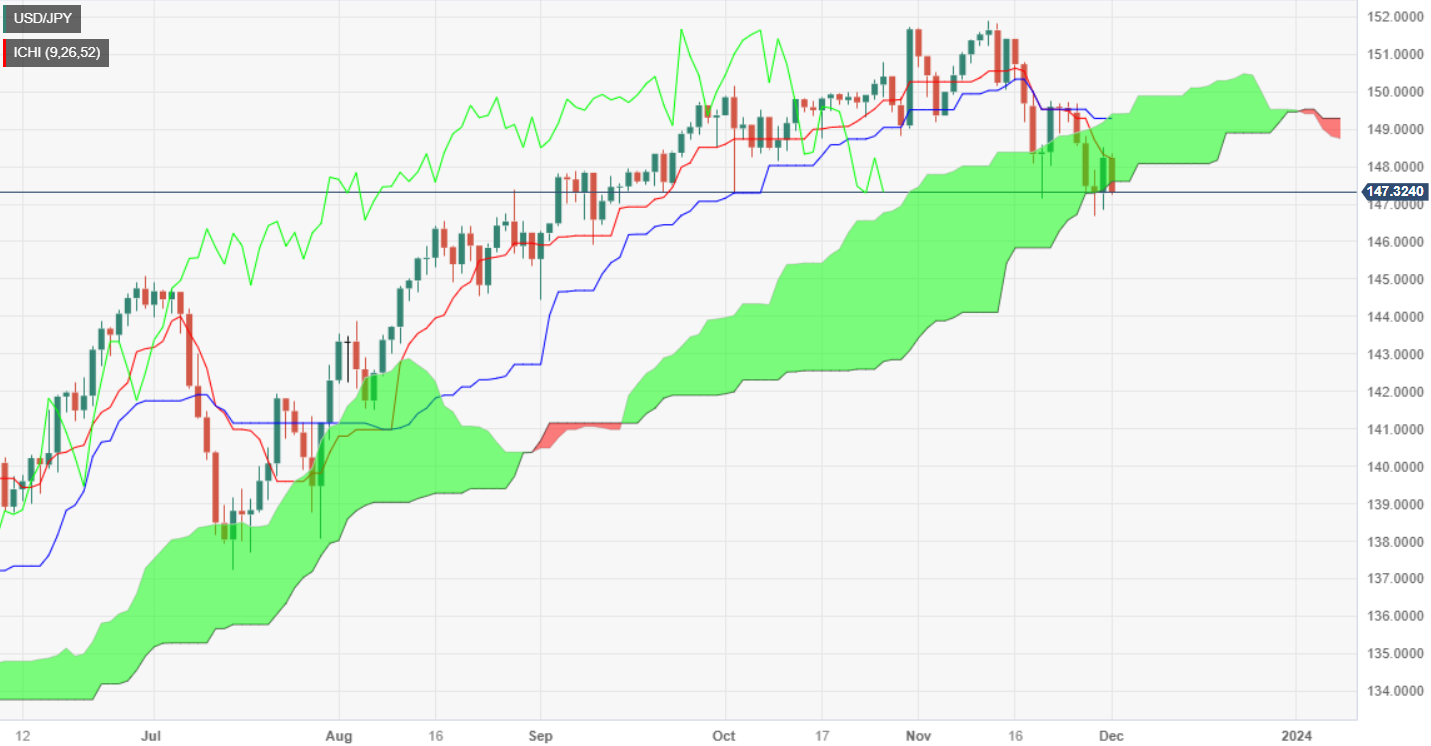

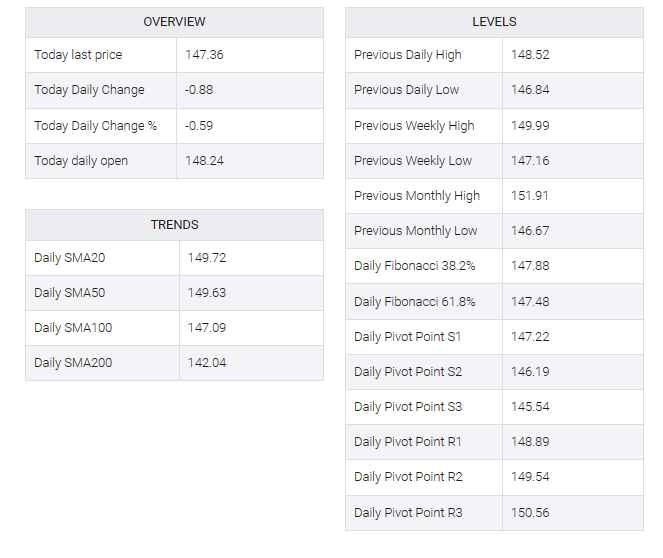

The USD/JPY trims some of its Thursday gains on Friday, diving below the Ichimoku Cloud (Kumo) early in the North American session. At the time of writing, the pair is exchanging hands at 147.35, registering losses of 0.58%.

USD/JPY drops due to a subdued ISM Manufacturing PMI, despite Powell’s neutral stance

The sudden US dollar weakness was triggered by a soft Institute for Supply Management (ISM) November reading, which showed business activity held steady at 46.7, unchanged from October’s reading and the 13th straight month below 50, the expansion/contraction threshold. , which indicates that the manufacturing sector is underperforming. The estimate for the ISM was 47.6, while some sub-components of the index such as employment showed that the labor market was easing. Regarding inflationary pressures, the price subcomponent jumped to 49.9 from 45.1, which may prevent Federal Reserve (Fed) officials from easing monetary policy.

Meanwhile, Fed Chairman Jerome Powell is going through the headlines. In prepared remarks, he acknowledged that inflation has come down, but core inflation is very high. He added that he needs to see more progress on bringing inflation down to his 2% target. He said rates are restrictive but it is “premature” to say that monetary policy is restrictive enough. Chair Powell said that a decision will be taken after the meeting.

On the Japanese front, the Jibun Bank Manufacturing PMI was in contraction territory at 48.3, above estimates but below October’s 48.7. Meanwhile, Japan’s labor market remains tight as the unemployment rate fell to 2.5% in October, data showed on Friday.

USD/JPY Price Analysis: Technical outlook

The downtrend remains in place, but the USD/JPY break below the Kumo could accelerate prices to fall toward the 146.00 figure. A daily close below 147.60, the bottom of the cloud, could open the door to test 147.00. A breach of the latter would expose the September 11 daily low of 145.89, before prices slump to September’s 1 swing low at 144.43. On the other hand, if buyers keep exchange rates inside the Kumo, that could pave the way for consolidation.