-

USD/JPY discovers an interim support near 149.50 after recovery in the US Dollar.

-

Economists expect that the US economy grew by 4.2% in the third quarter of 2023.

-

The BoJ announced that it will conduct an unscheduled bond operation on Wednesday.

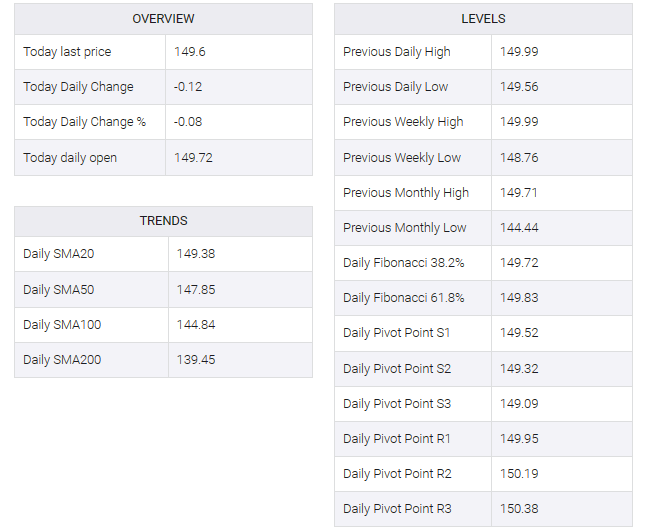

The USD/JPY pair found interim support near 149.50 after correcting from the crucial resistance of 150.00 in the European session. The asset found bids after recovering strongly from US$105.40 as focus shifted to a string of US economic readings, due to be released this week.

S&P500 futures generated significant gains in the London session, portraying an upbeat market mood. A delay in Israel’s ground attack on Gaza lifted market sentiment while near-term mood remained risk-free amid continued risks of Middle East conflict.

The US dollar recovered on expectations that expected Q3 gross domestic product (GDP) data, due out on Thursday, would boost hopes of further policy tightening by the Federal Reserve (Fed). As expected, the US economy grew by a strong 4.2%, against the previously recorded growth of 2.1%. The 10-year US Treasury yield fell to 4.83% as Fed policymakers continued to provide neutral guidance on interest rates.

Meanwhile, investors await Fed Chair Jerome Powell’s speech, scheduled for Wednesday. Jerome Powell is expected to reiterate the need to keep interest rates unchanged in the 5.25-5.50% range but will leave the door open for further policy tightening as the US economy remains resilient based on the labor market and consumer spending.

On the Japanese yen front, the Bank of Japan (BoJ) announced that it will conduct an unscheduled bond operation on Wednesday in which it will offer to buy JPY300 billion yen ($2.00 billion) of Japanese government bonds (JGBs) with maturities of five to 10 years and 10- 100 billion yen worth with a maturity of 25 years.