-

USD/JPY trades in positive territory for the second consecutive day on Tuesday.

-

The Japanese Producer Price Index (PPI) came in at 0.3% MoM in December vs. 0.2% prior, beating the estimation of 0%.

-

Investors anticipate the interest rate cuts as soon as a Fed meeting in March.

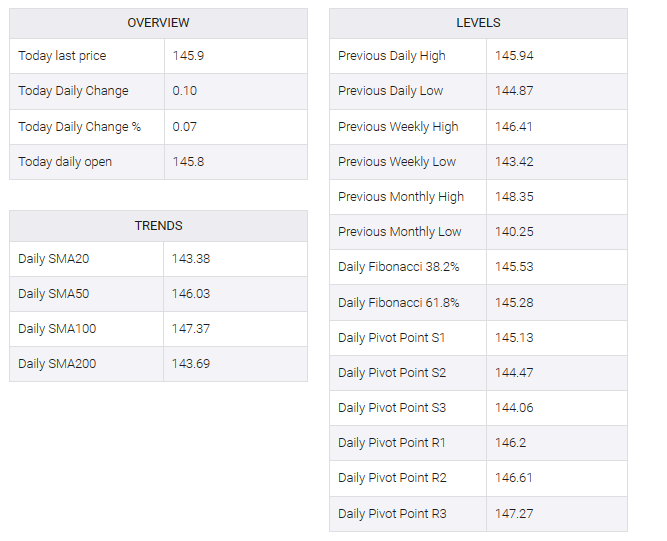

The USD/JPY pair holds positive ground below the 146.00 barrier during the early Asian session on Tuesday. The uptick of the pair is bolstered by the stronger US Dollar (USD) broadly. Investors await the US NY Empire State Manufacturing Index on Tuesday for fresh impetus, which is expected to show a decrease of 5 in January from a 14.5 fall in the previous reading. At press time, USD/JPY is trading at 145.90, gaining 0.08% on the day.

Data from Japan’s Statistics Bureau showed on Tuesday that the country’s producer price index (PPI) rose 0.3% MoM in December from 0.2% in November, beating estimates of 0%. On an annual basis, the PPI figure was flat from the previous reading of a 0.3% rise, above the market consensus of a 0.3% decline.

Bank of Japan (BoJ) Governor Kazuo Ueda has stressed the need to maintain ultra-loose monetary policy as he awaits more data that could show whether inflation will continue. He also said that the central bank will abolish negative rates when it is confident enough to achieve sustainable inflation of 2%.

Furthermore, there are reports that Iran’s Revolutionary Guards have been deployed to aid Houthi terrorists in Yemen. That said, tensions in the Middle East could boost safe-haven flows and benefit the Japanese yen (JPY).

On the other hand, market players are expecting interest rate cuts as soon as the Fed meets in March. According to the CME FedWatch tool, markets put the chance of a rate cut in March at about 71%. Atlanta Federal Reserve (Fed) President Raphael Bostick said inflation could “see” if policymakers cut interest rates too soon. Bostick added that inflation must return firmly and surely to our 2% target.

Later on Tuesday, the US NY Empire State Manufacturing Index will be released. Additionally, the Fed’s Christopher J. Waller may give some indication of further monetary policy stance later in the day. On Wednesday, attention will shift to US retail sales, which are projected to show a 0.4% increase in December. These figures can give a clear direction to the USD/JPY pair.