- The USD/JPY is recovering further ground after last week’s plunge, but Fed looms ahead.

- Markets are rebalancing after last week’s Yen rocket sparked by hawkish BoJ comments.

- Fed rate call expected to hold flat, investors to peer into FOMC statement and interest rate forecast.

USD/JPY pared the bulk of last week’s Bank of Japan (BoJ) fuel plunge, recovering from a four-month low below 142.00 to target a 147.00 handle. The pair has recovered nearly 80% of last Thursday’s decline that was triggered by an unexpectedly dovish display from BoJ Governor Kazuo Ueda, who indicated that the Japanese central bank may begin exploring tighter monetary policy as long as wages continue to show strong growth.

Markets fully ride the BoJ statements from the front, sending the Japanese yen (JPY) across the FX market space USD/JPY plunged nearly 4% top-to-bottom last week, but markets are reversing their bets as investors anticipate upcoming US Consumer Price Index (CPI) inflation and an update to the Federal Reserve’s (Fed) dot plot interest rate forecast.

Fed to hold rates, markets to hinge on dot plot adjustments

With Monday making a thin showing on the economic calendar, markets are focusing on Tuesday’s upcoming US CPI inflation print, which is expected to diverge between monthly and annualized price growth. November’s MoM CPI inflation is forecast to tick upwards from 0.0% in October to 0.1%, and YoY is expected to tick downwards from 3.2% to 3.1%.

With near-term inflation seen climbing slightly, an unexpected rebound in inflation on the near tail of the curve would undercut broad-market expectations of Fed rate cuts to come sooner rather than later, destabilizing risk appetite currently underpinning the broader market.

Wednesday kicks off with the Japanese Tankan Large Manufacturing Index for the quarter into October, forecast to climb from 9.0 to 10.0, and markets will begin to batten down the hatches ahead of Wednesday’s Fed Monetary Policy Statement and Interest Rate Projections.

With the Fed broadly set to hold rates at 5.5% for the last rate call of 2023, markets will be focusing on the hawkish or bearish lean to the Fed’s statement, as well as the changes to the Fed’s Interest Rate Projections, or Dot Plot, with a press conference from the Fed to follow.

USD/JPY Technical Outlook

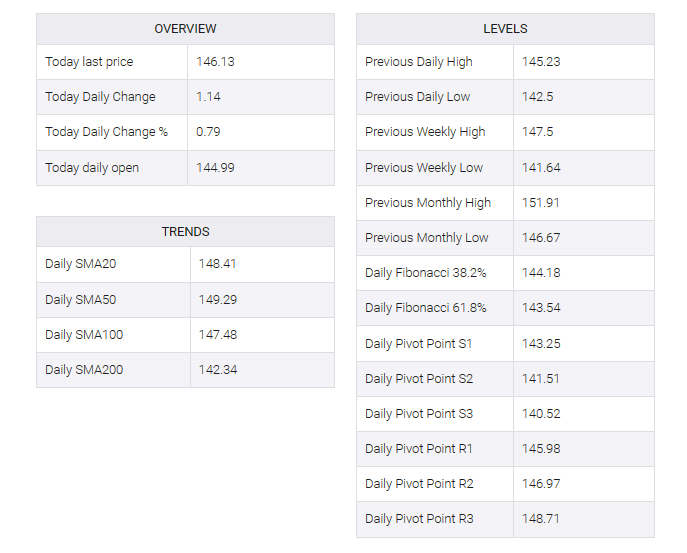

The USD/JPY climbed back over the 146.00 price level in Monday’s trading, extending a rebound from 145.00. The US Dollar’s plunge against the Yen saw the pair rebound tightly off the 200-day Simple Moving Average (SMA) just above 142.00.

The USD/JPY’s recent volatility has left the pair with few near-term technical barriers in either direction, and bids are strung across the midrange between the 200-day SMA floor and the technical ceiling at the 50-day SMA rotating bearishly towards the 149.00 handle.