-

USD/JPY climbs further as Yen declines across the board.

-

Yen weakness sparked by tumbling Japanese real wages, down 3% YoY.

-

Backsliding real wages leaves the BoJ less likely to start raising interest rates.

USD/JPY witnessed a significant rally in Wednesday’s trading, reaching 145.80 and key resistance at 146.00 as markets gear up for Thursday’s Asia market session. This upward movement was attributed to the significant depreciation of the Japanese Yen (JPY) across the market, which was triggered by the disappointing Japanese wage data released the previous day. As a result, the yen is undergoing a decline in various parts of the market mid-week.

Japan’s economic landscape faces challenges as nominal wages rose 0.2%, but real incomes fell 3% for the year ended November. Ongoing inflation is reducing consumer earnings and purchasing power, contributing to this recession.

The likelihood of the Bank of Japan (BoJ) implementing a rate hike, dependent on rising real wages, is diminishing. This has weakened the Yen and triggered another extended flight away from the JPY.

Japanese real wages tumble 3% despite 0.2% increase in nominal wages

Despite the continued impact of inflation on real wages, the BoJ maintains a highly accommodative monetary policy with a slightly negative rate at or around -0.1%. This cautious stance stems from concerns about inflation falling below the 2% threshold in 2025. Japan’s annual inflation stood at 2.8% in November, down from a peak of 4.3% in January the previous year.

Looking ahead, USD/JPY may gain additional momentum on Thursday as the US releases its latest Consumer Price Index (CPI) inflation figures for December.

US headline CPI inflation is expected to increase slightly from 0.1% to 0.2% month-on-month. Annual inflation is expected to rise to 3.2% from 3.1% for the year ending December.

US CPI Preview: Forecasts from 10 major banks

In contrast, core US CPI inflation, excluding volatile food and energy prices, is predicted to remain stable month-over-month in December at 0.3%. However, the year-over-year Core CPI is forecasted to decrease slightly from 4.0% to 3.8%.

Investors are closely monitoring any signs that could prompt the Federal Reserve (Fed) to initiate the next rate-cut cycle. A decline in US inflation may boost risk appetite, while an unexpected increase in US CPI inflation could lead to a decrease in risk appetite and potentially drive up the value of the US Dollar against major currencies.

USD/JPY Technical Outlook

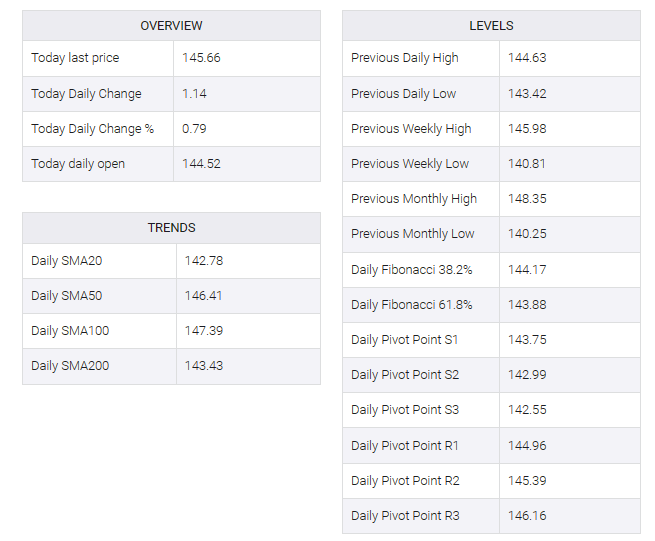

The recent decline in the Yen on Wednesday has propelled the USD/JPY pair, positioning it for a potential retest of last week’s peak at the 146.00 level. Short-term momentum suggests a bullish trend, with the 200-hour Simple Moving Average (SMA) ascending towards 143.50, aligning with Wednesday’s low point.

Despite the current consolidation between the 50-day and 200-day SMAs, the 2024 price action signals a bullish trend following the recent rebound of the USD/JPY from the 200-day SMA around 143.00.