-

USD/JPY remains under selling pressure near 148.45 amid the softer USD and lower yields.

-

USD continues to lose steam as the markets believe that the Fed is done with the interest rate hiking cycle.

-

The speculation that the BOJ may soon be forced to abandon its negative interest rate policy is growing.

-

Traders will focus on the US Housing Price Index, the S&P/Case-Shiller Home Price Indices, and CB Consumer Confidence.

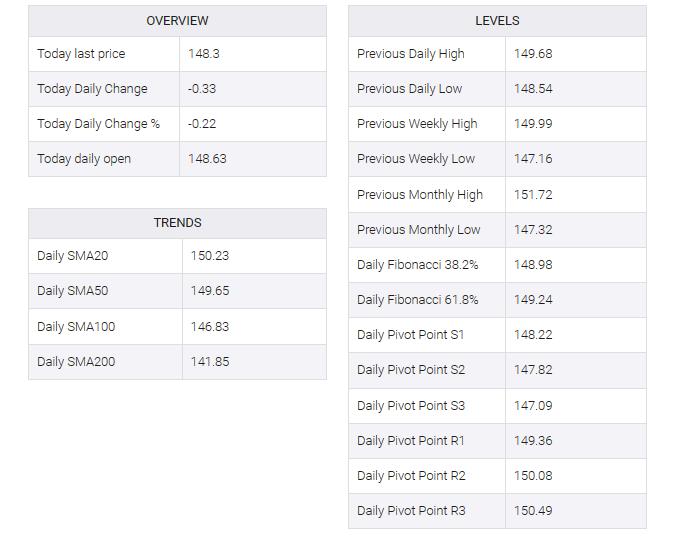

The USD/JPY pair traded in negative territory for the third day in a row during the early Asian session on Tuesday. The pair’s downtick was due to a weaker US dollar (USD) and lower US Treasury bond yields. The pair is currently trading near 148.45, losing 0.12% on the day.

The greenback continues to lose steam as markets believe the Federal Reserve (Fed) is done with the interest rate hiking cycle. US October new home sales fell 5.6% MoM to 679K in October, worse than market estimates of 725K, the US Census Bureau showed on Monday. Additionally, the Dallas Fed manufacturing index for November fell to 19.9, down from 19.2 in the previous reading.

On the Japanese yen front, Bank of Japan (BoJ) Governor Kazuo Ueda said on Monday that the central bank cannot yet ensure that inflation will reach its 2% target in a sustainable and stable manner.

As inflationary pressures appear more persistent than expected, speculation is growing that the BOJ may soon be forced to abandon its negative interest rate policy, as well as yield curve controls, which set a 0% cap on 10-year bond yields.

Market players will keep an on the US Housing Price Index, the S&P/Case-Shiller Home Price Indices, CB Consumer Confidence, and the Richmond Fed Manufacturing Index on Tuesday. Additionally, the Fed officials, including Goolsbee, Waller, Bowman, and Barr are set to speak later on Tuesday. Traders will take cues from these figures and find a trading opportunity around the USD/JPY pair.