-

USD/JPY regains some positive traction on Tuesday, albeit lacks follow-through.

-

Intervention fears, a softer risk tone underpin the JPY and cap gains for the pair.

-

The Fed-BoJ policy divergence should act as a tailwind ahead of the key US CPI.

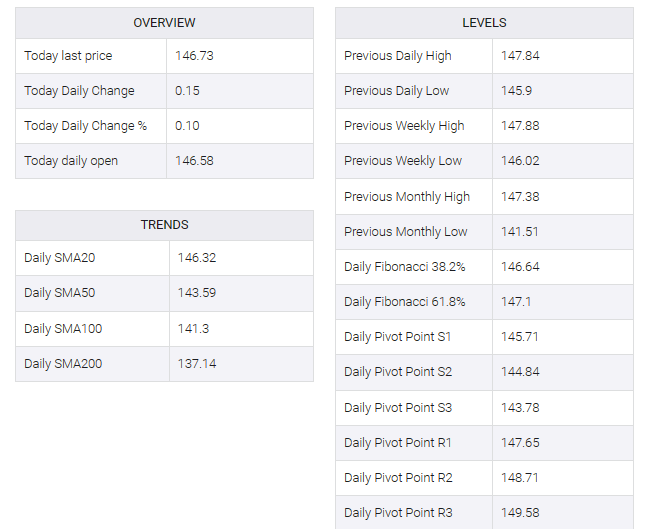

The USD/JPY pair formed on the previous day’s late rebound from the sub-146.00 level, or less than a week, and gained some positive traction on Tuesday. The spot price, however, struggled to capitalize on the momentum and retreat some pips from the 147.00 vicinity or daily high. The pair is currently trading around the 146.65-146.70 region, down 0.10% for the day.

The immediate market reaction to Bank of Japan (BoJ) Governor Kazuo Ueda’s hawkish comments faded rather quickly as market participants remained confident that the Japanese central bank would maintain the status quo until next summer. In an interview with the Yomiuri newspaper published on Saturday, Ueda said an end to negative interest rates is among the options available if the BoJ is confident that prices and wages will rise sustainably. That said, the upper house secretary-general of Japan’s ruling Liberal Democratic Party (LDP), Hiroshige Seko, has signaled his preference for an ultra-loose monetary policy. Seko added that BoJ Gov Ueda said an exit from easy policy would be made after achieving the 2% inflation target.

This eased market fears about an imminent shift in the BoJ’s dovish policy stance, acting as a tailwind for the USD/JPY pair with some US dollar (USD) buying emerging. Prospects of further policy tightening by the Federal Reserve (Fed) supported higher US Treasury bond yields and revived USD demand. The US central bank is expected to pause its rate-hiking cycle in September, although markets are pricing in the possibility of another 25 bps lift-off in 2023. Bets were reaffirmed by upbeat US macro data released last week, which pointed to a resilient economy. Moreover, inflation is not cooling fast enough to allow the Fed to hold interest rates longer.

Hence, the market focus will remain glued to the crucial US CPI report, due for release on Wednesday and will provide fresh cues about the Fed’s future rate hike path. This, in turn, will play a key role in influencing the near-term USD price dynamics and determining the next leg of a directional move for the USD/JPY pair. In the meantime, the prevalent cautious market mood is seen lending some support to the safe-haven Japanese Yen (JPY). Apart from this, speculations that Japanese authorities might intervene to halt any further weakness in the domestic currency act as a headwind for the major. The aforementioned fundamental backdrop, however, suggests that the path of least resistance for spot prices is to the upside.