-

USD/JPY remains above the 141.00 psychological level amid a weaker US Dollar.

-

The immediate resistance could be at the 141.50 major level following the 142.00 level.

-

Technical indicators suggest a bearish sentiment to retest the 141.00 psychological support.

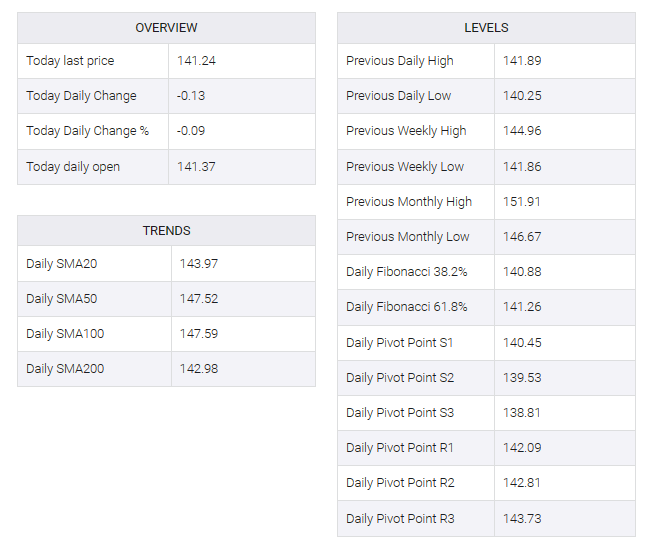

USD/JPY continues to experience declines, driven by the weakening US Dollar (USD) influenced by subdued US bond yields. This trend is likely attributed to the dovish outlook of the Federal Reserve (Fed) in the first quarter of 2024. As of the early European session on Friday, the USD/JPY trades lower around 141.20. The immediate resistance is noted at the 141.50 level, with the next barrier at the 142.00 level.

A breakthrough above the psychological level could provide support for the USD/JPY pair to approach the nine-day exponential moving average (EMA) at 142.24, with psychological resistance at the 143.00 level acting as a significant barrier. If the pair successfully crosses this level, the next hurdle to cross is the 23.6% Fibonacci retracement level at 143.35.

The 14-day Relative Strength Index (RSI) is staying below the 50 level points in a bearish sentiment for the USD/JPY pair. Adding to the bearish outlook, the Moving Average Convergence Divergence (MACD) line is positioned below both the centerline and the signal line, confirming bearish momentum in the USD/JPY market.

This bearish sentiment may drive the USD/JPY pair towards the psychological support region around 141.00. A decisive break below this level could potentially open the door for the pair to test the significant level at 140.50.