-

USD/JPY continues to decline further towards 140.00 amid soft US Dollar.

-

Investors await the US core PCE price index data for further guidance.

-

USD/JPY may find an intermediate cushion near upward-sloping trendline.

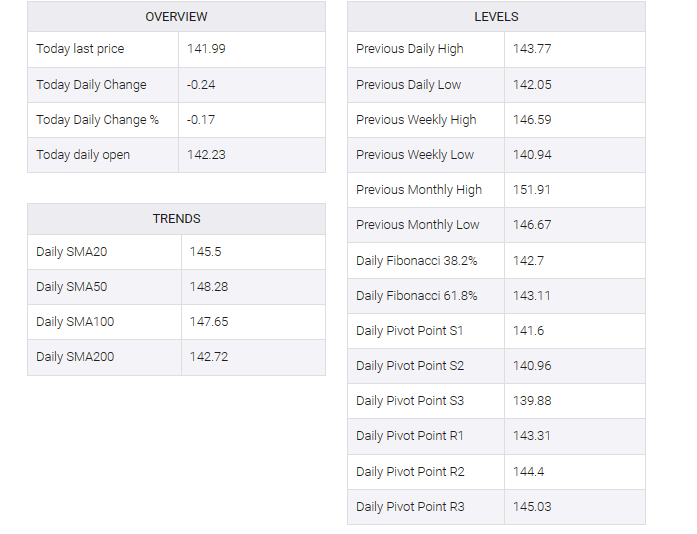

The USD/JPY pair consolidates in a tight range near 142.00 after a sharp correction ahead of the United States core Personal Consumption Expenditure (PCE) price index data for November, which will be published at 13:30 GMT.

The core PCE inflation report is expected to remain soft as the Federal Reserve (Fed) kept interest rates unchanged in the range of 5.25-5.50%. If underlying inflation turns softer than expected then the principal will continue to be on the downside. Meanwhile, expectations of a deeper rate cut from the Federal Reserve (Fed) weighed heavily on the US Dollar Index (DXY). The USD index refreshed near its four-month low of 101.55.

On the Tokyo front, Japan’s National Consumer Price Index (CPI) was above the 2% target for the 20th consecutive time. The Bank of Japan (BoJ) is expected to maintain its ultra-accommodative policy stance until wage growth in the Japanese economy is high enough to keep inflation comfortably above 2%.

USD/JPY has been falling consistently for over a month. Downward momentum accelerated after a bearish crossover from the 20 and 50-day exponential moving averages (EMA), which closed near 148.80. The asset is expected to decline further towards the upward-sloping trendline plotted at the 16 January low of 127.22.

The Relative Strength Index (RSI) (14) oscillated in the bearish range of 20.00-40.000, indicating continuation of a downward trend.

Fresh downside would appear if the asset drops below December 14 low near 141.00. This would drag it towards the upward-sloping trendline near 139.40, followed by July 28 low near 138.00.

In an alternate scenario, a recovery move above December 19 high near 145.00 would drive the asset towards December 11 high around 146.60, followed by December 6 high near 148.00.