-

USD/JPY moves on the downward trajectory to an eight-week low.

-

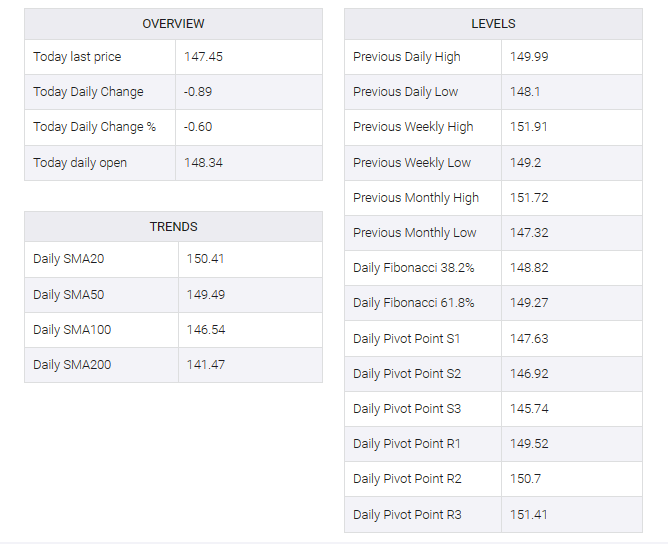

147.00 psychological level appears to be a key support following the 38.2% Fibonacci retracement.

-

A breakthrough above the 148.00 level could support the pair to explore the region near the nine-day EMA.

USD/JPY extended a losing streak that began on Thursday and marked an eight-week low, trading near 147.40 during the European session on Tuesday. 147.00 psychological level emerged as immediate support after 38.2% Fibonacci retracement at 146.32.

The US dollar (USD) fell to a near three-month low on dovish expectations from the Federal Reserve (Fed). This development is a significant factor contributing to the fall in the USD/JPY pair.

The 14-day Relative Strength Index (RSI) is below the 50 level, indicating a weak sentiment for the USD/JPY pair. This could prompt a possible bearish move towards the psychological support zone near 146.00. If a decisive break below this level occurs, it could pave the way for the USD/JPY pair to navigate to the area near the 50.0% retracement to the 144.60 level.

Furthermore, the Moving Average Convergence Divergence (MACD) line is positioned below the center line and deviates below the signal line, signaling a bearish momentum in the market for the USD/JPY pair.

On the upside, the key level at 147.50 acts as an immediate barrier, followed by the psychological level at 148.00. A move above the latter could provide support to the USD/JPY pair to explore the area around the 149.00 level following the nine-day exponential moving average (EMA) at 149.62.