-

USD/JPY retreats with a positive bias, holding grounds below 149.50.

-

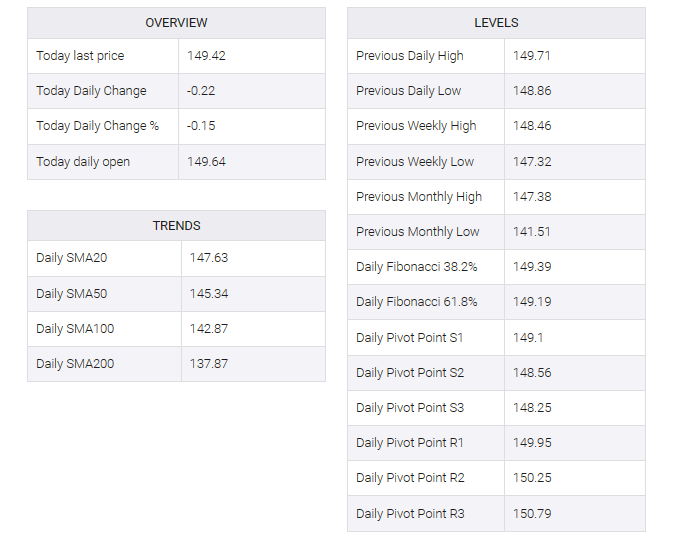

Momentum indicators point toward a prevailing bullish sentiment in the market.

-

The psychological level at 150.00 could emerge as a key resistance, following October’s high.

USD/JPY retreats with a positive bias from the highs since November, trading lower around 149.40 during the Asian session on Thursday. The pair experiences upward support due to market caution about the US Federal Reserve’s (Fed) interest rate trajectory, coupled with higher US Treasury yields and economic data.

However, Japan’s Finance Minister Shunichi Suzuki confirmed on Thursday that he is ready to take the necessary steps to address excessive foreign exchange (FX) market volatility. Suzuki also emphasizes that currencies move in a stable manner. Policymakers are closely watching FX movements, though declined to comment on any plans for rate checks.

The current upside momentum in USD/JPY appears to have a potential bullish bias as the 14-day Relative Strength Index (RSI) remains above the 50 level. However, there is a psychological resistance level at 150.00 that could pose a challenge for further gains.

If there is a strong advance above the level, it could serve as an incentive for USD/JPY bulls to explore higher levels, potentially targeting the area around the October high of 151.94.

On the upside, the USD/JPY pair may encounter significant support levels in its price movement. The first significant support level could be near the 14-day exponential moving average (EMA) at 148.27. Below that, there is a psychological support level at 148.00, which often holds significance in market dynamics.

If the pair breaks below the latter, it could navigate towards the area around the psychological support level at 147.00, followed by the 23.6% Fibonacci retracement at 146.76.

The Moving Average Convergence Divergence (MACD) indicator is providing a bullish signal for the USD/JPY pair. The MACD line is positioned above both the centerline and the signal line. This configuration suggests that there is potentially strong momentum in the USD/JPY’s price movement, indicating a prevailing bullish sentiment in the market.