-

USD/JPY trades back and forth around 149.00 amid a risk-off mood.

-

The Middle East tension could suck in foreign players.

-

USD/JPY trades inside the ‘flash clash’ candlestick formed on October 3, which was misinterpreted as BoJ’s intervention.

The USD/JPY pair consolidated in a narrow range around 149.00 as investors were torn between supporting the US dollar and the Japanese yen amid a risk-off mood. Rising tensions between Israel and Hamas have fueled expectations of other Middle Eastern economies participating in the war, which has greatly affected demand for safe-haven assets.

USD/JPY remains on the upside as upside is limited by hopes of Bank of Japan (BoJ) intervention in the FX domain to support the Japanese Yen while the downside is well supported by surprisingly buoyant Nonfarm Payrolls (NFP). The report indicated the expectation of another interest rate hike from the Federal Reserve (Fed).

This week, the headline is expected to remain volatile as the US Consumer Price Index (CPI) is released on Thursday. Core consumer price inflation is expected to rise at a steady pace of 0.3% in September.

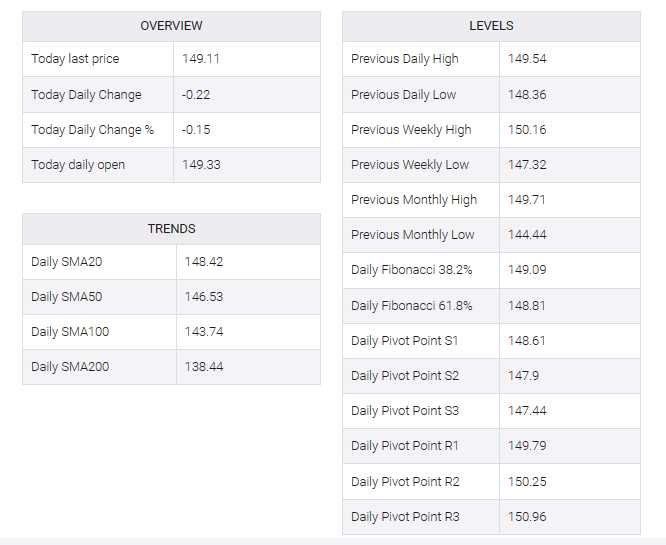

USD/JPY traded in a ‘flash clash’ candlestick formed on October 3, which was misinterpreted as intervention by the BoJ. Clarification from Bank of Japan (BoJ) money market data that the flash crash action was not due to central bank intervention. The asset is trading closely with the 50-period exponential moving average (EMA) at 149.00, indicating a sideways move ahead.

Also, the Relative Strength Index (RSI) (14) oscillates in the 40.00-60.00, indicating that investors await a fresh trigger.

Going forward, a decisive break above October 03 high at 151.16 would drive the asset toward 21 October 2022 high around 152.00 and a fresh multi-decade high of 155.00.

On the contrary, a breakdown below October 3 low at 147.32 would expose the major to September 11 low at 145.90, followed by September 01 low at 144.44.