-

USD/JPY climbs quickly above 146.50 as investors reconsider bets supporting a rate cut from the Fed in March.

-

Fed Bostic sees a slowdown in progress in inflation declining towards 2%.

-

Upbeat Japan’s PPI data failed to offer cushion to the Japanese Yen.

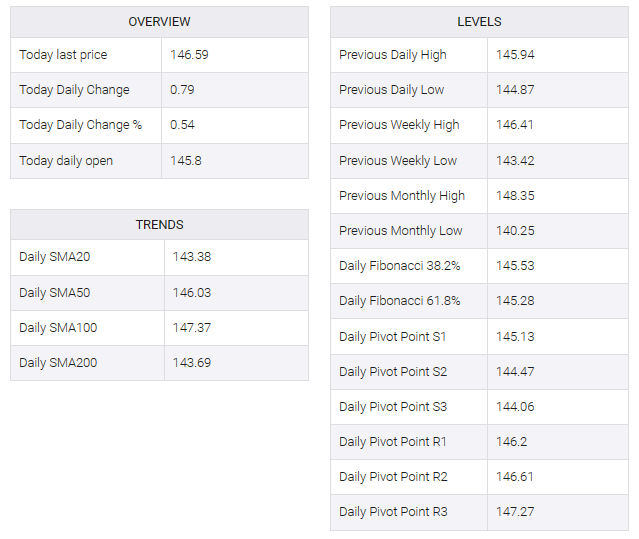

The USD/JPY pair printed a new monthly high at 146.60 in the European session. The major has witnessed a significant buying interest as investors are reconsidering bets supporting the decision to cut rates by the Federal Reserve (Fed) in March.

U.S. economic data, released for December, indicated that the last leg of consumer price inflation is still stubborn, labor demand is steady, but business owners are cutting the prices of goods and services at the factory gate. This indicates that the risk of inflation continuing is still high.

Traders see a 66% chance of the Fed cutting interest rates by 25 basis points (bps) in March, up from 70% as of Monday’s trading session, according to the CME Fedwatch tool. Atlanta Fed President Raphael Bostic’s comments pushed back market expectations of an initial rate cut as he warned of a slow return of inflation to the 2% target.

S&P500 futures posted significant losses in the European session, indicating a sharp decline in risk-appetite among market participants. The US Dollar Index (DXY) printed a new weekly high above 103.00 amid cautious market mood. The 10-year US Treasury yield climbed above 4.0%.

On the Tokyo front, producer price index (PPI) data for December failed to lift the Japanese yen. The monthly increase in PPI was steady at 0.3% as investors expected a stagnant performance. Annual PPI data was flat against a 0.3% increase in November. Investors forecast a 0.3% annual decline in prices of goods and services at the factory gates.