-

USD/JPY receives upward support due to the rebound in the US Dollar.

-

Former Fed Vice Chair Clarida expects adjustment in the BoJ’s approach by early 2024.

-

Fed’s hawkish stance on policy rate trajectory provides strength to the US Bond yields.

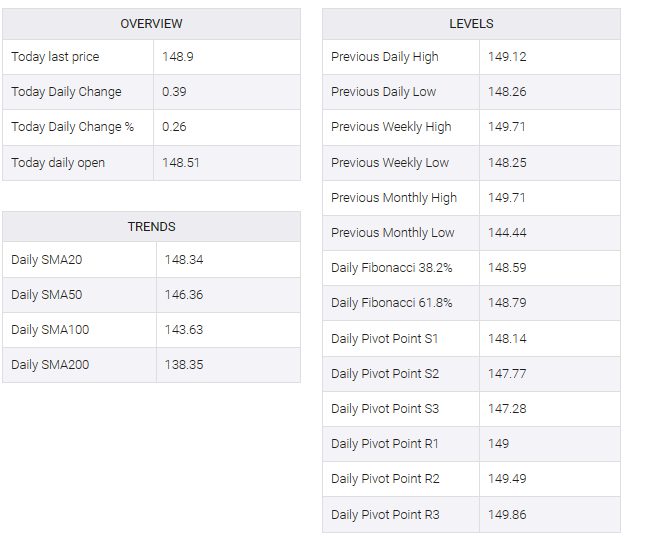

USD/JPY recovers from the recent losses, trading higher around 148.90 during the early European session on Friday. The pair finds support on the upside, which could be attributed to the rebound in the US Dollar (USD) following improved US Treasury yields.

Japan’s Labor Cash Earnings (YoY) remained consistent at 1.1% in August, contrasting with the market expectations of 1.5%.

Former Federal Reserve Vice Chair Clarida has suggested that the Bank of Japan (BoJ) policy rate may rise to 0% as early as 2024. Recent changes under the new leadership of Governor Kazuo Ueda, including a significant adjustment to the yield curve in July, signal a change in the BoJ’s approach to control (YCC) strategy.

Japanese Finance Minister Shunichi Suzuki on Thursday reiterated his decision not to comment on whether Japan has intervened in the foreign exchange (FX) market. Ongoing speculation about possible intervention of the Japanese authorities in the foreign exchange market to strengthen the domestic currency may continue to be a headwind for the USD/JPY pair.

Moreover, BoJ Governor Kazuo Ueda emphasized that the current policy framework has a significant stimulating effect on the economy. Ueda reiterated the central bank’s fundamental stance of patiently maintaining monetary easing.

The US Dollar Index (DXY) rebounded and traded near 106.50 so far. The greenback’s correction comes after hitting an 11-month high earlier this week.

US Treasury yields held steady, holding their positions near multi-year highs. Market participants are cautious due to the US Federal Reserve’s (Fed) taunts on the path of interest rates.

The 10-year US Treasury yield remained above 4.70%, near the highest level since 2007.

US initial jobless claims for the week ended September 29 rose to 207K from the previous reading of 205K. Surprisingly, it surpassed market expectations of 210K.

US Challenger job cuts significantly decreased to 47.457K from 75.151K in September. Market participants watch Friday’s upcoming release of US nonfarm payrolls and average hourly earnings.

These figures will serve as confirmation of the tight labor market, and optimistic numbers could potentially boost USD growth and volatility in bond markets.