-

USD/JPY snaps a two-day losing streak near 145.00 on Monday.

-

The downbeat US PPI has triggered the possibility that the Federal Reserve (Fed) will start cutting interest rates this year.

-

Japan’s two-year yield has declined back under zero for the first time since July 2023.

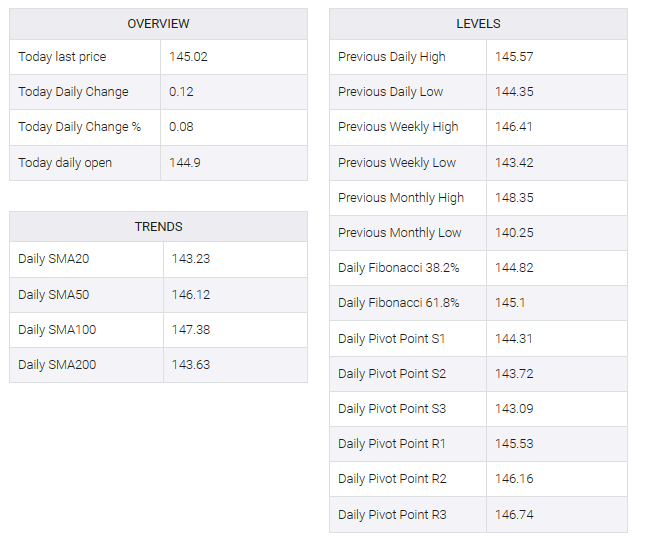

The USD/JPY pair gained traction above the 145.00 mark in the early Asian session on Monday. The pair rebounded despite the fall in the US Dollar (USD). Markets are likely to have a quieter session amid the US bank holiday At press time, USD/JPY is trading at 145.06, up 0.12% for the day.

The US producer price index (PPI) unexpectedly fell in December, raising the possibility that the Federal Reserve (Fed) will start cutting interest rates this year. The market priced rates 86% lower in March, with the overall easing cycle in 2024 priced at about 166 basis points (bps), compared to the 75 bps estimated by the Fed dot plot. This, in turn, could cap the greenback’s upside and act as a headwind for the USD/JPY pair.

Japan’s two-year yield from July 2023 fell below zero for the first time. On Friday, reports said the Bank of Japan (BOJ) may cut its core inflation forecast (currently 2.8%) for the 2024 fiscal year due to the recent fall in oil prices. In addition, the BOJ is expected to maintain its estimate that trend inflation will remain close to its 2% target in the coming years despite global economic uncertainty and lackluster spending. The projection will form part of the bank’s quarterly outlook report at the next rate review on January 22-23. The BoJ board is widely expected to keep ultra-loose policy settings unchanged.

Looking ahead, the Japanese Machine Tool Orders are due on Monday. However, this low-tier data might not impact the market. Later this week, the Japanese Producer Price Index and the US NY Empire State Manufacturing Index will be released on Tuesday. The US Retail Sales will be due on Wednesday. Traders will take cues from these figures and find trading opportunities around the USD/JPY pair.