-

USD/JPY edges lower on Wednesday and stalls the overnight recovery from a multi-month low.

-

Firming expectations that the Fed is done raising rates undermines the USD and cap the upside.

-

Speculations that the BoJ will end its negative rates policy in early 2024 also act as a headwind.

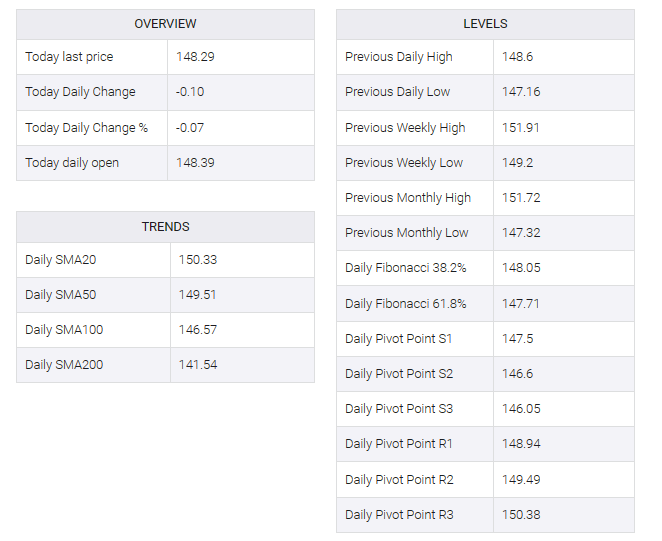

The USD/JPY pair is struggling to capitalize on the previous day’s tough 140-145 pip recovery from the 147.15 area, or its lowest level since September 14, and to sustain a tick during the Asian session on Wednesday. The spot price, however, managed to hold above the 148.00 round figure and remains at the mercy of US Dollar (USD) price movements.

The USD got a minor lift on Tuesday and bounced to near three-month lows in response to the FOMC minutes, which supported policymakers keeping interest rates high for a longer period to control inflation. But investors are confident the US central bank will keep rates steady rather than hiking. Furthermore, current market prices point to the possibility of a first-rate cut at the April 30-May 1 FOMC policy meeting. This was reinforced by the fact that the yield on the benchmark 10-year US government bond remained near a two-month low and acted as a headwind for the greenback.

The Japanese yen (JPY), on the other hand, is supported by a narrowing of the US-Japan rate differential and speculation that the Bank of Japan (BoJ) will almost certainly end its negative rate policy in the first few months of 2024. Changes to its yield curve control (YCC) policy follow the BoJ’s decision last month to relax the cap on long-term rates. Moreover, BoJ Governor Kazuo Ueda said last week that Japan is making sustained progress toward its 2% inflation target and that the central bank will not necessarily wait until real wages turn positive to exit the decade-long accommodative policy setting.

This, in turn, suggests that the overnight recovery can still be classified as a short-covering rally, especially after the recent decline of around 500 pips from around 152.00, or the retest of the YTD peak earlier this month. Moreover, the fundamental backdrop mentioned above suggests that the path of least resistance for the USD/JPY pair remains on the downside. Market participants are now looking to the US economic docket, which includes weekly preliminary jobless claims data, durable goods orders and a revised Michigan consumer sentiment index, for some inspiration later in the first North American session.