-

The USD/JPY is paring back some of Thursday’s losses, climbing back into the 145.00 handle.

-

The US Dollar is fighting back after a steep decline sparked by a hawkish BoJ.

-

US NFP figures beat expectations, keeping the Greenback bid through Friday market action.

USD/JPY bounced back on Friday after posting an extreme pullback on Thursday, climbing four-tenths of a percent from the day’s opening bid and trying to cut losses. The US dollar (USD) traded flat against the Japanese yen (JPY) before the yen slipped after a broad-market rally on the back of unusually hawkish comments from the Bank of Japan (BoJ). Governor Kazuo Ueda.

The greenback is trying to claw back on the chart paper on Friday, returning to the 145.00 handle after a brief dip to 142.50 at the start of the week’s final trading session.

US Nonfarm Payrolls (NFP) broadly beat the Street on Friday, posting a net gain of 199K jobs in November against forecasts of 180K and climbing over October’s net job gain of 150K. Broader markets are betting on an accelerated path towards rate cuts from the Federal Reserve (Fed), with many market participants expecting the first rate cut from the Fed as early as next March.

A still-tight U.S. labor market threw a small wrench into jobs adding more jobs than expected, accelerating average hourly earnings in November, which came in at 0.4% MoM, compared to forecasts of 0.3%. Workers’ earnings appear to be picking up in the near term after October printed 0.2% MoM.

Also read: US nonfarm payrolls rose 199,000 in November

Despite the dollar-positive NFP release, USD/JPY remained deep red for the trading week while the yen rose to its single best trading day in 13 months, on speculation that the BoJ may finally end its negative rate hike as Japan’s central bank moves toward tighter monetary policy. Governance

Despite fears that Japan’s inflation will moderate in 2025, Japanese core consumer price index (CPI) inflation is running higher than expected, reaching 2.9% through October and outpacing the BoJ for the nineteenth straight month of inflation. 2% upper target band.

BoJ Governor Ueda indicated that if the BoJ begins to accelerate wage growth around 2024, the BoJ may begin to tighten monetary policy, given a broad-market bid splurge that pushed USD/JPY to 4% peak-to-true on Thursday. Rolled up. The US dollar recovered some ground, and Friday’s market continued to see a moderate upward move, but still far from the week’s high bid.

Next week will be another Fed Watch scenario, with the Federal Reserve delivering their last rate call for 2023, followed by the Fed’s ‘dot plot’, or summary of forward-looking inflation expectations. Any decline in the Fed’s inflation forecast would likely spark a mark risk relief rally, and further weaken the US dollar as investors bid for a Fed rate cut.

Japanese Yen price this week

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this week. Japanese Yen was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.30% | 1.42% | 0.84% | 1.76% | -1.07% | 1.60% | 1.50% | |

| EUR | -1.33% | 0.13% | -0.46% | 0.47% | -2.41% | 0.30% | 0.19% | |

| GBP | -1.45% | -0.12% | -0.58% | 0.35% | -2.52% | 0.17% | 0.07% | |

| CAD | -0.85% | 0.46% | 0.59% | 0.93% | -1.94% | 0.76% | 0.64% | |

| AUD | -1.79% | -0.47% | -0.34% | -0.93% | -2.91% | -0.15% | -0.27% | |

| JPY | 1.02% | 2.36% | 2.63% | 1.92% | 2.82% | 2.66% | 2.52% | |

| NZD | -1.61% | -0.29% | -0.17% | -0.75% | 0.17% | -2.68% | -0.09% | |

| CHF | -1.52% | -0.18% | -0.05% | -0.64% | 0.28% | -2.58% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

USD/JPY Technical Outlook

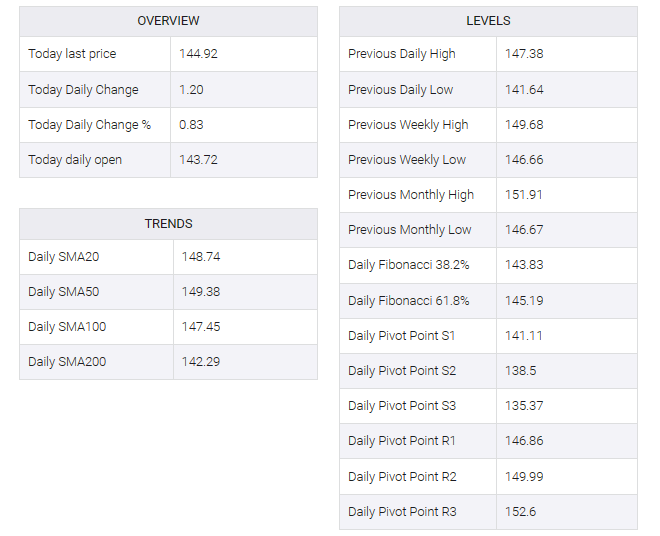

The US Dollar is up four-tenths of a percent against the Yen on Friday, and looking for further upside momentum after climbing from Friday’s early low of 142.50. Topside technical resistance from the 50-hour Simple Moving Average sits nearby just beyond the 145.00 handle, with further pressure from the 200-hour SMA descending into 146.75.

Thursday’s dip and Friday’s moderate recovery sees the USD/JPY setting up a technical bounce from the 200-day SMA just above 142.00, and the trick for Greenback bidders will be to push the pair back towards the 147.00 handle, where they can take a fresh run at the 50-day SMA parked just below the 150.00 major price level.