-

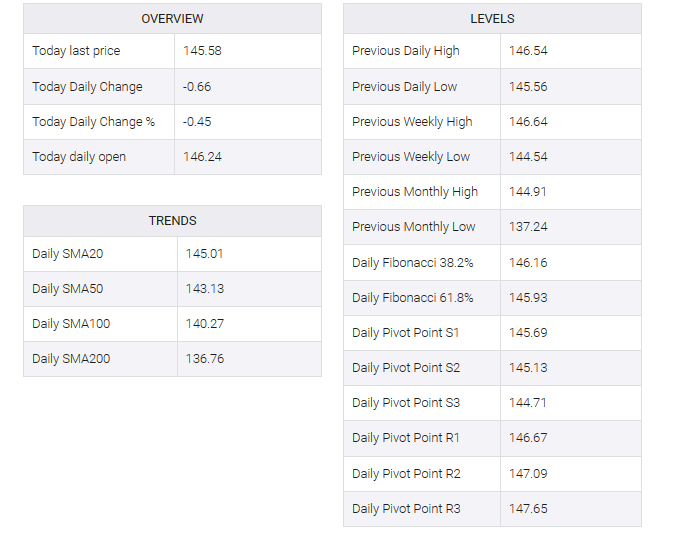

USD/JPY trades at 145.60, down 0.42%, as positive US data fails to lift the pair; DXY advances 0.51% to 103.718 but can’t buoy USD/JPY.

-

CME FedWatch Tool suggests the Fed will keep rates unchanged in September.

-

Japan’s retail sales exceed expectations with a 6.8% YoY increase, but a disappointing 2.4% contraction in Industrial Production adds to BoJ’s policy dilemma.

The Greenback (USD) prints losses against the Japanese Yen (JPY) after reaching a daily high of 146.22, back below 146.00. Data from the United States (US) came better than expected but failed to bring the USD/JPY to life. The pair is trading at 145.60, down 0.42%

Greenback struggles to attain gains vs. the Yen despite better-than-expected data

A busy weekly economic agenda kept most US dollar pegged currency pairs trading volatile. After Tuesday and Wednesday’s session, Buck was under a lot of pressure. However, it has regained some of its composure against most G10 FX currencies except the Japanese yen.

The US Commerce Department revealed that the US Federal Reserve’s (Fed) preferred measure of inflation, core personal consumption expenditure (PCE), came in as expected, rising 4.2% YoY and 0.2% MoM, in line with street forecasts. Regarding headline inflation, PCE was unchanged at 3.3% YoY and 0.2%.

Other data showed that initial jobless claims for the week ended Aug. 26 came in at 228K, below forecasts of 235K, according to the US Labor Department. This, in contrast to the latest jobs data released, indicated that the labor market is losing steam.

Today’s data added to past US jobs releases, along with month-end flows based on the US dollar (USD), which bottomed out and climbed according to the US dollar index (DXY). The DXY, an index that tracks the performance of a basket of six currencies against the USD, advanced 0.51%, to 103.718.

Although economic growth lost a step, it remained above the previous estimate of 2% at 2.1% in the second quarter. That, alongside the US Commerce Department saying consumer spending held steady, jumping 0.8% in July, could keep the Fed under control. The CME FedWatch tool, which charts traders’ beliefs about rising borrowing costs in the U.S., shows the Fed will keep rates unchanged at its September meeting. However, for November, the odds for a 25 bps increase remain at 44.1%.

Meanwhile, Atlanta Fed President Raphael Bostick said policy was appropriately constrained to bring inflation toward the US central bank’s 2% target over a “reasonable” period.

On the Japanese front, Bank of Japan (BoJ) policymakers are split between normalizing monetary policy and continuing stimulus. BoJ board member Toyoki Nakamura said it was premature to tighten monetary conditions, as higher import prices had driven inflation. He added that once the “inflationary mentality” is eradicated, the BoJ will not need yield curve control (YCC).

According to the data, Japan’s retail sales exceeded expectations by 5.4% YoY and rose 6.8% in July, while industrial production plunged -2.4%, disappointing investors, who had expected a -1.4% contraction.

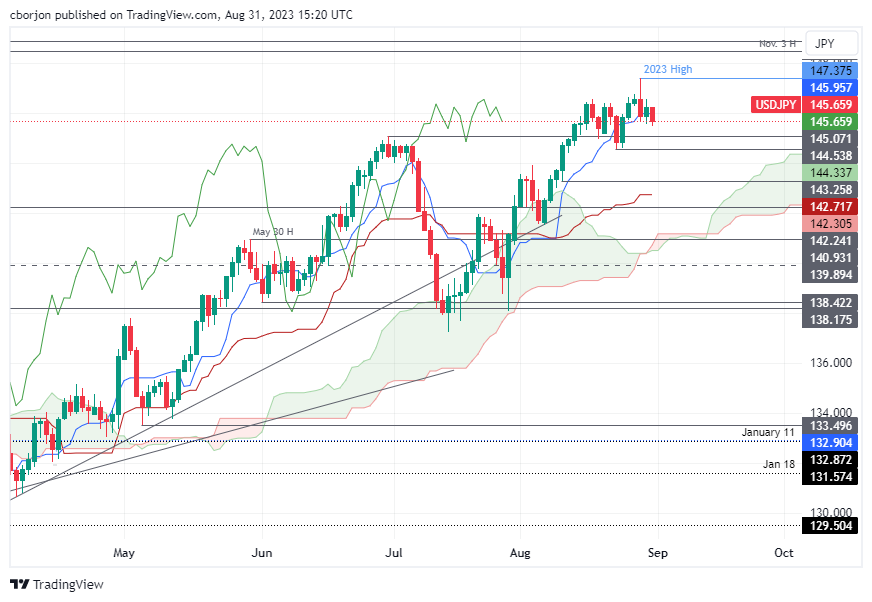

USD/JPY Price Analysis: Technical outlook

The pair remains upward biased despite falling below the Tenkan-Sen, which has been recovered by buyers early in Thursday’s session. Even though the bulls are in charge, the USD/JPY must climb above yesterday’s high of 146.53 to pave the way for further upside, eyeing the year-to-date (YTD) high of 147.37. Otherwise, downside risks emerge below 145.55, which, once cleared, the major can dive and test the August 23 swing low of 144.54.