-

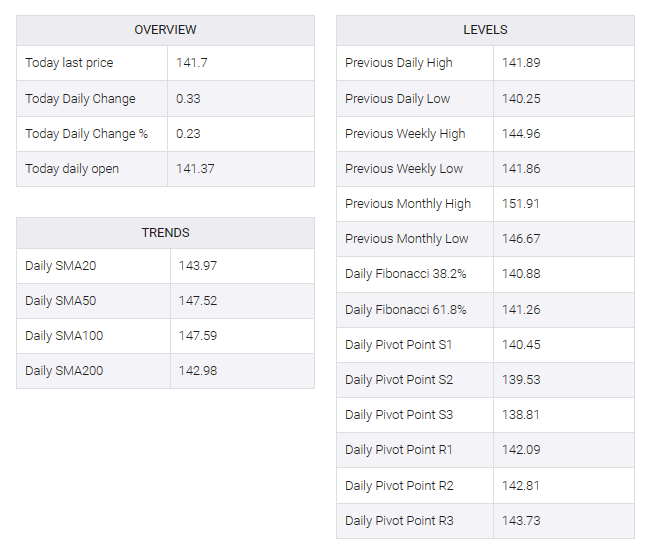

The Greenback is trading at intra-day highs nearing previous support at the 141.90 area.

-

The US Dollar Index is resuming its recovery on thin holiday trade.

-

Longer-term, the downtrend from mid-November highs remains intact.

The US Dollar is attempting to extend its rebound from Thursday´s lows, yet with the pair still capped below previous support at 141.90, which leaves the 140.00 level on the bear´s focus.

The yen has been the worst performer of the G7 currencies this year, but it has pared some losses in the past two months, with the US dollar crushed by expectations of a Fed deficit in 2024.

Beyond that, the Bank of Japan is expected to exit its ultra-loose policy next year even as conflicting messages from BoJ officials have frustrated investors and weighed on a strong yen recovery.

Trading is expected to be light on the final business day of the year, with only the Chicago PMI offering some distraction. Investors will look ahead to next week with the last Fed meeting, US PMI and above all December non-farm payrolls to make directional bets on the USD.

The technical picture remains negative yet with bearish momentum losing steam, as shown by the last three week’s falling wedge. This figure has a bias to break lower although support levels at 140.00 and 139.00, the 261% extension of the mid-November decline are likely to challenge bears

On the upside, resistances are at 141.90 and 142.90.