-

USD/JPY crosses 135.50 as DXY rebounds strongly ahead of Fed policy.

-

An interest rate decision by the Fed will widen the Fed-BOJ policy divergence.

-

The BOJ will continue its ultra-loose monetary policy to boost growth rates.

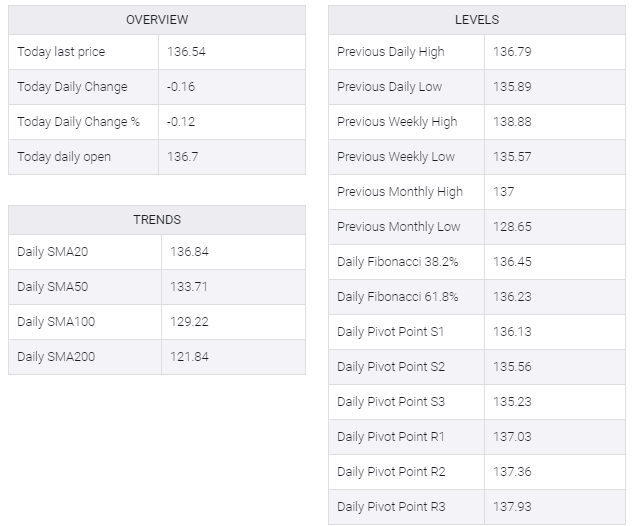

The USD/JPY pair has displayed a meaningful rebound after hitting a low of 136.30 in the Asian session. The asset has surpassed the crucial hurdle of 135.50 and is heading towards Monday’s high at 136.80. Market mood is expected to turn sour as investors usually get anxious ahead of the interest rate decision by the Federal Reserve (Fed).

With the Fed’s rate hike announcement, USD/JPY could be the main victim as Fed-Bank of Japan (BOJ) policy divergence widens. There is no denying that the option of a 1% rate hike is not viable now that the US economy faces recessionary conditions ahead. However, price pressures remain in the US economy and the Fed will announce a rate hike by 75 basis points (bps).

While the BOJ is committed to flush liquidity in the economy as it has been fragile after the pandemic period and has yet not returned to its pre-pandemic levels. This will escalate the Fed-BOJ policy divergence and may strengthen the pair more.

Apart from the Fed policy, investors’ focus will remain on the US Durable Goods Orders data, due on Wednesday. The economic data is seen at -0.2%, lower than the prior release of 0.8%. This indicates a severe slump in the aggregate demand as Retail data remained higher, contaminated with higher energy bills and expensive food products.