- USDCHF retains a neutral pace ahead of US CPI inflation

- Encouraging signals detected, but rally above 0.8600 required

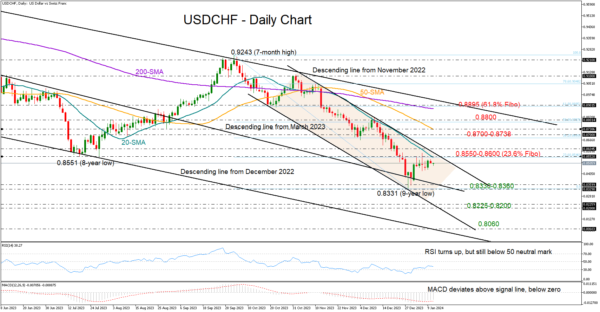

USDCHF has been gently moving sideways, unable to post durable gains above the 0.8500 level after the bounce off a nine-month low of 0.8331 at the end of 2023.

Both the RSI and the MACD have been trending up over the past week, reflecting improving sentiment in the market. Yet, the former is still some distance below its 50 neutral mark, indicating some persisting discomfort as investors eagerly wait for the US CPI inflation figures to reassess their rate cut bets later today at 13:30 GMT.

The area between the 20-day simple moving average (SMA) at 0.8550 and the 0.8600 round level, which encapsulates the 23.6% Fibonacci retracement of the latest downfall and November’s resistance trendline, will be closely watched on the upside. A successful penetration higher could reach the 0.8700 mark and the 50-day SMA, while higher, the bulls will attempt to pierce through the 0.8800 number to test the 200-day SMA and the important 61.8% Fibonacci region of 0.8895.

Should the bears take over, support could immediately come from the descending trendline from March 2023 at 0.8360 and December’s trough of 0.8331. A step lower is expected to test the channel’s lower boundary within the 0.8225-0.8200 region. If that floor cracks as well, the sell-off might expand to 0.8060, where the descending line from December 2022 is positioned.

All in all, USDCHF is holding a neutral status in the short-term picture and a bearish one in the medium-term as the downtrend from October remains valid. A decisive close above 0.8600 could raise the odds for a bullish trend reversal. Otherwise, the bears could push for new lower lows.