- Core PCE inflation to fall further on Friday 13:30 GMT, no big surprises expected

- Philly Fed manufacturing index, new home sales also on the agenda

- Investors see more than three rate cuts in 2024; US dollar could react moderately

The transition to monetary easing

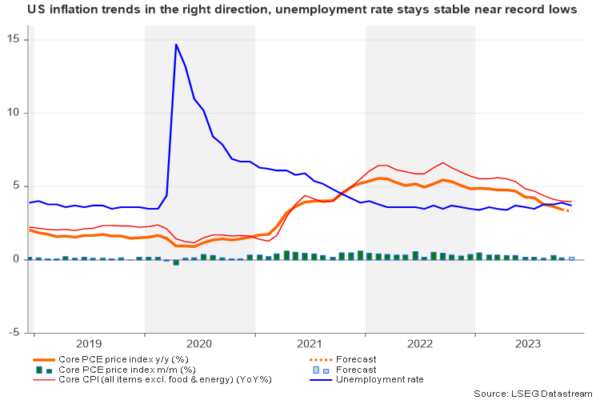

The transition to monetary easing could be a hot theme in 2024. Global central banks excluding the Bank of Japan were more or less synchronized in their battle against high inflation following the pandemic price shock, delivering the most aggressive rate hiking cycle in decades. It’s still uncertain if this disinflation is mainly a result of normalizing supply chains or indeed because of tighter financial conditions (or both). In any case, inflation reacted in the right way, cooling substantially from its highs without causing a significant increase in the unemployment rate in 2023.

Although the possibility of another rate increase has not entirely evaporated as geopolitics and elevated wages keep threatening another upturn in inflation, Fed policymakers are now more confident to discuss a potential shift to rate cuts, probably because they are still concerned about the delayed effects of high borrowing costs in an important election year. The median projection of 19 Fed officials showed at least three reductions to 4.5% in 2024 during last week’s FOMC policy meeting, with futures markets currently awaiting the first 25 bps slash to come as soon as in March with a 65% probability. That said, market pricing should not be taken for granted as there are still three months ahead of data collection and sentiment could easily change.

US calendar to get busy, but little chance of festive cheer for the dollar

The Philadelphia Fed manufacturing index could come first into view on Thursday at 13:30 GMT. Forecasts are pointing to improving but still negative business conditions in the festive month of December, with the index expected to strengthen from -5.9 to -3.0.

Then on Friday at the same time, the focus will fall on the Fed’s favorite inflation measure, the core PCE price index for November. Analysts predict a slowdown to 3.3% y/y from 3.5% previously and a stable monthly increase of 0.2%. Other details of the report may reveal a moderate monthly pickup in personal income to 0.4% from 0.2% before and a steady expansion of 0.3% in personal consumption.

As regards the inflation trends, the CPI report has already updated investors on November’s price tendencies, whilst the S&P Global manufacturing PMI figures released last week have also informed investors about the latest changes in business sentiment. Hence, this week’s data may not trigger a notable pre-Christmas rally in the greenback, likely causing a balanced reaction in markets instead. Nevertheless, it would be interesting to see if the rise in medical care expenses, shelter & housing, and transportation persisted in the PCE report as the CPI data showed.

Meanwhile, traders could also pay attention to the Philly Fed employment and new orders sub-indices, which have been lacking strength since the start of the year. New home sales due on the same day at 15:00 GMT have been trending downwards as well over the past four months.

USD/JPY levels to watch

Following last week’s stronger-than-expected retail sales, another round of upbeat reports could somewhat ease investors’ aggressive pricing of 150 bps of rate cuts by the end of 2024. Consequently, USDJPY could crawl higher to test the 145.00 level. If the bulls claim that barrier, closing above the 20-day simple moving average (SMA) too, the pair could next head for the 147.75-148.50 region.

In the event the data arrives worse than analysts anticipate, increasing the odds for a rate cut in March, the pair could slump to meet its 200-day SMA at 142.65. A continuation lower could initially challenge the almost five-month low of 140.94, while a steeper decline could meet the support trendline, which connects the lows from January and March, near 139.30.