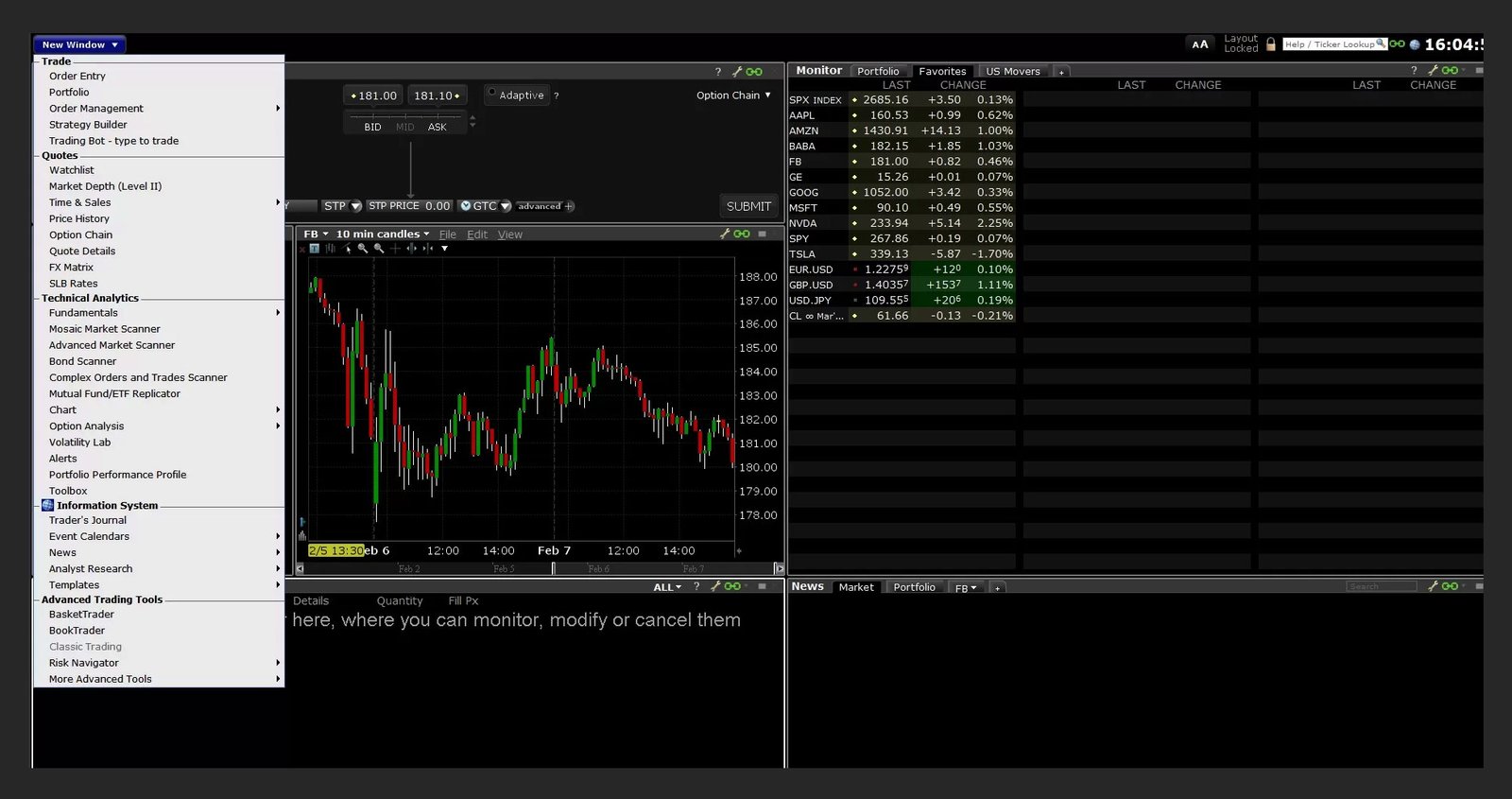

Additionally, the brokerage offers trading options through its AMO (All Markets Online). AMO directly market connectivity (DMA) to more than 620,000 electronic traded products, including Stocks, Options, Bonds, Mutual Funds, ETFs and many more.

In addition, Windsor Brokers provides all account holders (demo accounts with) the access the Traders room, which includes a range of useful features and tools , such as a calendar of economic events, news and the learning center and daily technical analysis Profit Calculator, among others. All of these are for free.

The Company. Security of Funds

Windsor Brokers is one of the longest-running Forex broker in the business. Since its inception in 1988, the company offers trading of currency pairs as well as precious metals, and a variety of CFD instruments through a variety of trading platforms.

Behind the brand lies Windsor Brokers Ltd., an entity licensed by the Cyprus Securities and Exchange Commission (CySEC). CySEC enforces certain guidelines and regulations for licensed companies and pays attention the compliance of their companies. They are required to keep customer funds in separate accounts that are separate from operating company funds and must keep at least 730,000 euros in order to show their financial health.

To further protect the funds of clients that all CySEC-regulated firms are part of the Investor Compensation Fund, which is able to offer an amount of compensation that is up to 200.000 EUR when a company is in financial trouble.

Furthermore What’s more, each CySEClicensed investment company is MiFID certified and thus able to provide cross-border services within the EU in accordance with MiFID regulations. MiFID regulations.

The brokerage also runs an offshore division that is called Windsor Brokers (BZ) Ltd. It is regulated through the International Financial Services Commission (“IFSC”) of Belize. It provides as many as seven types of accounts, as well as, in addition to CFDs and forex customers can also trade binary options.

Trading Conditions

Minimum Initial Deposit

To create an account at Windsor Brokers, traders have to make an investment as low as $100.

Spreads & Commissions

Windsor Brokers offers tight variable spreads with an average of 0.4 percent on EUR/USD using the MT4 platform. There is a fee of $4 is applied for each standard lots (per side) which means the price for trading per lot will be about 1.2 per cent for this currency pair, which is very excellent.

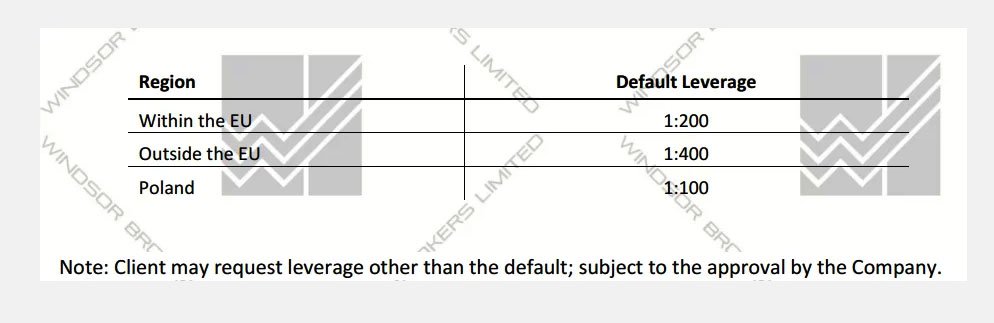

Leverage

The maximum leverage allowed at Windsor Brokers is 1:400. This is a common ratio in those in the FX market, but it is thought to be high because the higher leverage, the more risk. This is the reason leverage is limited in certain countries, like the US, Japan, and Poland. Recently, CySEC also suggested the default leverage for Cypriot broker firms to be 1:150. In the case of Windsor Brokers, the default leverage is based on the customer’s location of residence:

Trading Platforms

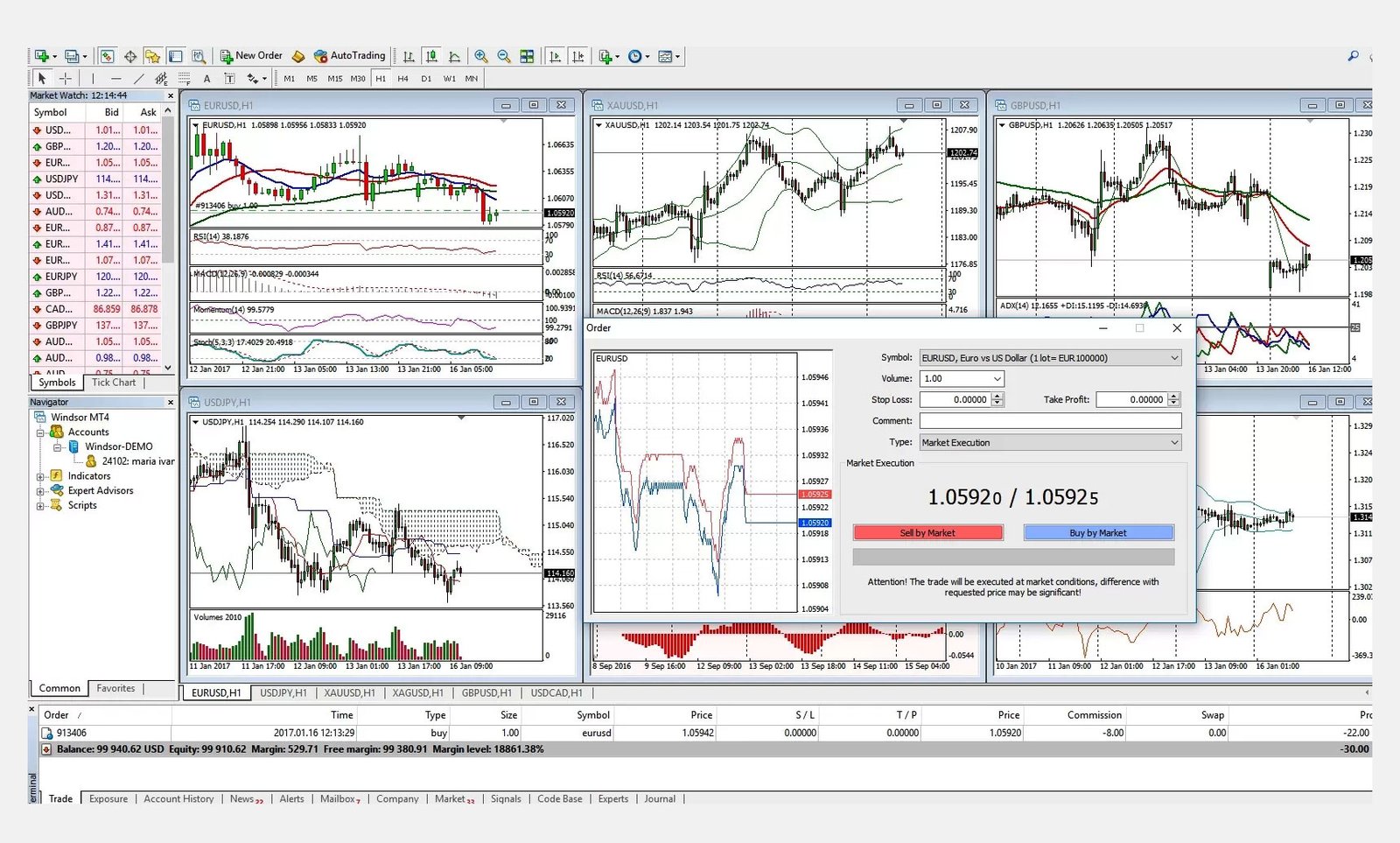

This broker works with the forex market trading system MetaTrader4 (MT4), as in addition to its own Gwasy. Both come in tablet, mobile, and desktop versions.

MT4 is the most popular choice of traders around the world since it comes with an extensive range of tools and resources for trading that include More than 50 of the built-in indicators for technical trading that are advanced charting software, a broad selection of Expert Advisors (EAs) and an extensive set of back-testing tools for the. Traders can download pre-made EAs, or develop your own EAs as well as let the software complete the task.

Windsor Brokers’ proprietary platform Gwasy was released in 2013 and is an easy-to-use web-based platform. It is currently not accessible to broker’s customers. Windsor Brokers offers them an alternative option – the highly-featured multi-device WindsorAMO platform that lets users trade over 600,000.00financial assets from over 100 markets across the globe from a single account.

Methods of Payment

Windsor Brokers supports a wide selection of payment methods: Bank Wire Transfer, Skrill, Neteller, WebMoney WU – The Quick Pay option, China Union Pay, Western Union. Debit and credit cards from those brands listed below are accepted: Visa, Visa Electron, Master Card, Maestro, Discover.

Conclusion

Windsor Brokers is a well-regulated FX and CFD broker that allows trading with a variety of instruments across two different trading platforms. The major issue for Windsor Brokers is that its offers a hefty commission on FX trading.

| Windsor Brokers Summary | |

|---|---|

| Windsor Brokers Details | Information |

| Regulators | BaFin, CySEC, FCA, MiFID |

| Country |  Cyprus Cyprus |

| Base Currencies | USD, EUR |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, Mobile, MT4 |

| Established Year | 1988 |

| Website Language | English, Chinese, Spanish |

| US Clients | |

| Windsor Brokers Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.0 |

| Commission | |

| Fixed Spreads | |

| Windsor Brokers Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Skrill, Skrill,  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card Master Card |

| Acc Withdrawal Methods |  Skrill, Skrill,  Wire transfer, Wire transfer,  Visa Card, Visa Card,  Master Card Master Card |

| Windsor Brokers Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| Windsor Brokers Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:400 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | 500 USD |

| Islamic Account | |

| Windsor Brokers Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| Windsor Brokers Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +44 3301280930 |

| support@windsorbrokers.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | 35 Barrack Road, 2nd Floor, Unit 204, Belize City, Belize |

Germany

Germany United Kingdom

United Kingdom