YaMarkets Advantages

Trading on MT5

One of the undisputed benefits of YaMarkets, even though it has a poor reputation and is that it provides its services with the most up-to-date MetaQuotes software, called the MetaTrader5. The MT5 retains many of the features that were in its predecessor, MetaTrader4 which includes the best charting capabilities, the use of automatic trading methods, simple customizing and many more.

Many asset classes are covered include cryptocurrencies, as well as other asset classes.

YaMarkets provides trading in more than 60 currencies that include a range different exotic currencies. The product range also includes numerous CFDs on commodities, spot metals, indexes, German and US government bonds, and the most well-known cryptocurrency options: Bitcoin, Bitcoin Cash, Dash, Ethereum, Ethereum Classic, Litecoin, Monero, Ripple and Zcash.

However, if you’re a crypto-loving person then you should choose an accredited broker that is regulated and offers Bitcoin CFDs.

YaMarkets Disadvantages

Unregulated business

YaMarkets is a trademark owned by YaMarkets Ltd. and claims to be a member of the Financial Markets Compliance & Dispute Association (FMCDA). We have looked over many brokers, however this Association is not known to us. In addition, FMCDA is not accessible as of the date when we wrote this article, which means we could not find any information about its membership requirements. However, since YaMarkets’s official address is located in the UK and it is under the control under the supervision of Financial Conduct Authority (FCA).

It is the case that YaMarkets has not been licensed by FCA or any other foreign agency, generally indicates that the broker is operating in a way that is illegal. For those who might not have any knowledge of the Forex industry Financial regulation is extremely crucial. If you trade with broker, your complete account balance is in danger and the possibility that you may not receive any compensation, whenever you make a request for a withdrawal. Although we cannot say for certain that YaMarkets is a fraud but there’s no definitive way to prove their credibility.

High Spreads high spreads

YaMarkets hasn’t announced the costs for trading on its website. This isn’t at all surprising given the fact that it’s over high than the average of the business.

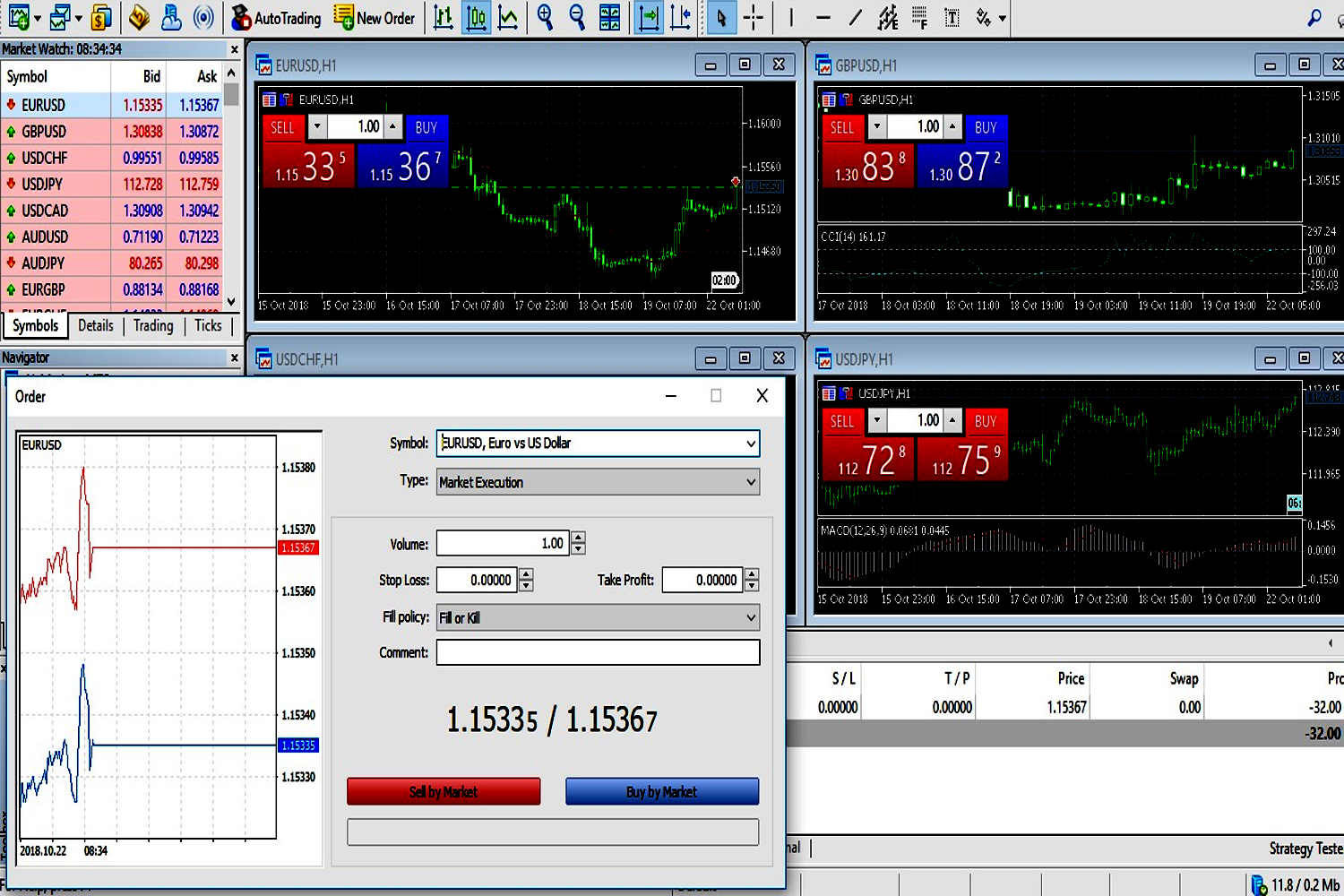

YaMarkets’s MT5 in demo mode. Click the picture to zoom into.

We tried our broker’s MT5 in Demo mode for the purposes of this test, and we discovered that the EUR/USD spreads were fluctuating between 3.1 to 3.2 per cent. These spreads are over two times greater than the median spread in the marketplace.

Conclusion

YaMarkets provides nothing unique in the field of foreign exchange: trading forex, and a wide selection of CFDs on MT5 that have high margins as well as high rates of leverage as well as lots of doubt about the firm behind the company. Naturally, the second is the most alarming of all. We continue to stress that the legal standing of a broker in the forex market is the most crucial factor to consider when deciding the right company to invest in. Do not believe what you read on the websites of brokers, or the words of a sales broker’s representative tells you over the telephone.

Many countries have dedicated agencies with responsibility for financial services providers, and public registers, which contain their names for all legitimate firms.

The UK’s FCA enforces strict requirements on brokers of foreign exchange in the UK that ensure traders an high quality of service. The most important thing is that all FCA-licensed brokers are protected by the Financial Services Compensation Scheme (FSCS) and in the event of an insolvency the maximum payout of PS50,000 per individual.

| YaMarkets Summary | |

|---|---|

| YaMarkets Details | Information |

| Regulators | |

| Country |  United Kingdom United Kingdom |

| Base Currencies | USD, EUR, GBP |

| Type Of Brokers | ECN, STP |

| Trading Platform | Desktop, Mobile, MT4 |

| Established Year | 2018 |

| Website Language | English |

| US Clients | |

| YaMarkets Spreads | |

|---|---|

| Option | Information |

| Minimum Spreads | 0.5 |

| Commission | |

| Fixed Spreads | |

| YaMarkets Payment & Withdrawal Option | |

|---|---|

| Option | Information |

| Acc Funding Methods |  Skrill, Skrill,  WebMoney, WebMoney,  Perfect Money Perfect Money |

| Acc Withdrawal Methods |  Skrill, Skrill,  WebMoney, WebMoney,  Perfect Money Perfect Money |

| YaMarkets Suitable For | |

|---|---|

| Option | Information |

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading | |

| YaMarkets Trading Account Options | |

|---|---|

| Option | Information |

| Maximum Leverage | 1:500 |

| Mini Account | |

| VIP Accounts | |

| Segregated Accounts | |

| Free Demo Accounts | |

| Managed Accounts | |

| Pro Account | |

| Minimum Deposit | $1000 |

| Islamic Account | |

| YaMarkets Trading Services | |

|---|---|

| Option | Information |

| Hedging | |

| News Trading | |

| Scalping | |

| Automated Trading | |

| Indices | |

| Commodities | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy Tradings | |

| YaMarkets Contact & Support | |

|---|---|

| Option | Information |

| Telephone No | +44 2074425676 |

| support@yamarkets.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | 38, Whitley Wood Lane, Reading RG2 8PP, UK |